UPS 2013 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2013 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

69

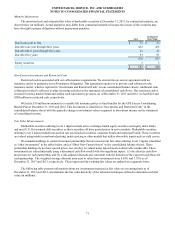

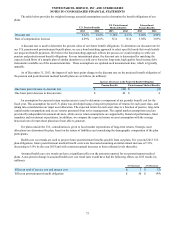

In December 2011, the FASB issued an Accounting Standards Update that required entities disclose both gross and net

information about instruments and transactions eligible for offset in the statement of financial position, as well as instruments

and transactions subject to a master netting arrangement. In addition, the update requires disclosure of collateral received and

posted in connection with master netting agreements or similar arrangements. This requirement became effective for us

beginning with the first quarter of 2013. This update did not have a material effect on our consolidated financial position or

results of operations, and we have included the required disclosures in all applicable filings since implementation.

In July 2012, the FASB issued an Accounting Standards Update that added an optional qualitative assessment for

determining whether an indefinite-lived intangible asset is impaired. The objective of this update is to reduce the cost and

complexity of performing an impairment test for indefinite-lived intangible assets by allowing an entity the option to make a

qualitative evaluation about the likelihood of an intangible impairment to determine whether it should calculate the fair value of

the asset. This accounting standards update also amends existing guidance by expanding upon the examples of events and

circumstances that an entity should consider between annual impairment tests in determining whether it is more likely than not

that the fair value of the intangible asset is less than its carrying amount. We adopted this accounting standard update and

applied its provisions to certain of our intangible assets for our annual impairment testing as of October 1, 2012.

In February 2013, the FASB issued an accounting standards update that adds new disclosure requirements for items

reclassified out of accumulated other comprehensive income. This update requires that companies present either in a single

note or parenthetically on the face of the financial statements, the effect of significant amounts reclassified from each

component of accumulated other comprehensive income based on its source (e.g., the release due to cash flow hedges from

interest rate contracts) and the income statement line items affected by the reclassification (e.g., interest income or interest

expense). If a component is not required to be reclassified to net income in its entirety (e.g., the net periodic pension cost),

companies would instead cross reference to the related note for additional information (e.g., the pension note). We adopted this

accounting standard update in the first quarter of 2013 and have included the required presentation in all applicable filings since

that date (see note 9).

Other accounting pronouncements adopted during the periods covered by the consolidated financial statements had an

immaterial impact on our consolidated financial position and results of operations.

Accounting Standards Issued But Not Yet Effective

Accounting pronouncements issued, but not effective until after December 31, 2013, are not expected to have a

significant impact on our consolidated financial position or results of operations.

Changes in Presentation

Certain prior year amounts have been reclassified to conform to the current year presentation. These reclassifications had

no impact on our financial position or results of operations.

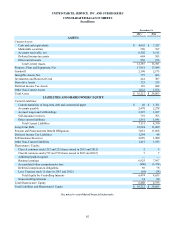

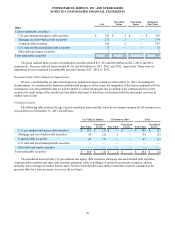

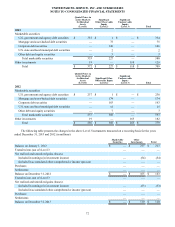

NOTE 2. CASH AND INVESTMENTS

The following is a summary of marketable securities classified as available-for-sale at December 31, 2013 and 2012 (in

millions):

Cost Unrealized

Gains Unrealized

Losses Estimated

Fair Value

2013

Current marketable securities:

U.S. government and agency debt securities $ 355 $ — $ (1) $ 354

Mortgage and asset-backed debt securities 76 1 (2) 75

Corporate debt securities 146 1 (1) 146

U.S. state and local municipal debt securities 2 — — 2

Other debt and equity securities 3 — — 3

Total marketable securities $ 582 $ 2 $ (4) $ 580