UPS 2013 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2013 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

80

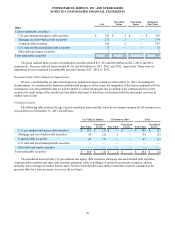

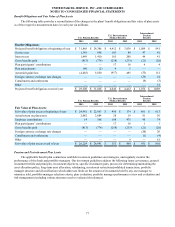

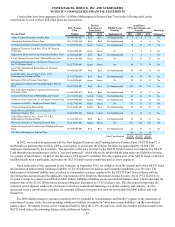

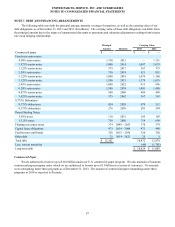

The fair values of U.S. and international pension and postretirement benefit plan assets by asset category as of

December 31, 2012 are presented below (in millions), as well as the percentage that each category comprises of our total plan

assets and the respective target allocations. This table has been revised from our 2012 Form 10-K filing to include international

plan assets in conformity with the 2013 presentation of international plan assets.

Level 1 Level 2 Level 3 Total

Assets

Percentage of

Plan Assets -

2012

Target

Allocation

2012

Asset Category (U.S. Plans):

Cash and cash equivalents $ 103 $ 139 $ — $ 242 0.9% 0-5

Equity Securities:

U.S. Large Cap 2,548 2,162 — 4,710

U.S. Small Cap 450 31 — 481

Emerging Markets 1,160 123 — 1,283

Global Equity 2,242 — — 2,242

International Equity 442 694 — 1,136

Total Equity Securities 6,842 3,010 — 9,852 38.8 35-55

Fixed Income Securities:

U.S. Government Securities 4,008 443 — 4,451

Corporate Bonds 9 3,113 138 3,260

Global Bonds — 457 — 457

Municipal Bonds — 83 — 83

Total Fixed Income Securities 4,017 4,096 138 8,251 32.5 25-35

Other Investments:

Hedge Funds — — 2,829 2,829 11.1 5-15

Private Equity — — 1,416 1,416 5.6 1-10

Real Estate 177 23 1,039 1,239 4.9 1-10

Structured Products(1) — 210 — 210 0.8 0-5

Other(2) — — 1,362 1,362 5.4 1-10

Total U.S. Plan Assets $11,139 $ 7,478 $ 6,784 $ 25,401 100.0%

Asset Category (International Plans):

Cash and cash equivalents $ 5 $ 17 $ — 22 2.8 0-5

Equity Securities:

Local Markets Equity 118 79 — 197

U.S. Equity 14 — — 14

International / Global Equity 71 59 — 130

Total Equity Securities 203 138 — 341 42.6 50-65

Fixed Income Securities:

Local Government Bonds 64 — — 64

Corporate Bonds 85 70 — 155

Total Fixed Income Securities 149 70 — 219 27.3 15-35

Other Investments:

Real Estate — 46 — 46 5.7 0-17

Structured Products(1) — — 49 49 6.1 0-10

Other — 124 — 124 15.5 0-20

Total International Plan Assets $ 357 $ 395 $ 49 $ 801 100.0%

Total Plan Assets $11,496 $ 7,873 $ 6,833 $ 26,202

(1) Represents mortgage and asset-backed securities.

(2) Represents global balanced-risk commingled funds, consisting primarily of equity, bonds, and some currencies and commodities.