UPS 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

51

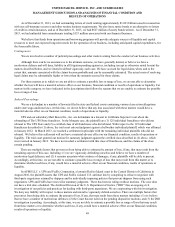

In January 2008, a class action complaint was filed in the United States District Court for the Eastern District of New

York alleging price-fixing activities relating to the provision of freight forwarding services. UPS was not named in this case. In

July 2009, the plaintiffs filed a First Amended Complaint naming numerous global freight forwarders as defendants. UPS and

UPS Supply Chain Solutions are among the 60 defendants named in the amended complaint. The plaintiffs filed a Second

Amended Complaint in October 2010, which we moved to dismiss. In August 2012, the Court granted our motion to dismiss

all claims relevant to UPS in the Second Amended Complaint, with leave to amend. The plaintiffs filed a Third Amended

Complaint in November 2012. We filed another motion to dismiss. On September 20, 2013, the Magistrate Judge

recommended to the Court that UPS be dismissed from one of the claims in the Third Amended Complaint, with prejudice, but

recommended that UPS's motion to dismiss with respect to other claims in the Third Amended Complaint be denied. UPS and

other defendants filed objections to the recommendations of the Magistrate Judge to the extent they recommended denial of

UPS's motion to dismiss. Those objections are currently pending before the Court. There are multiple factors that prevent us

from being able to estimate the amount of loss, if any, that may result from these matters including: (1) the Court's pending

review of the adequacy of the Third Amended Complaint; (2) the scope and size of the proposed class is ill-defined; (3) there

are significant legal questions about the adequacy and standing of the putative class representatives; and (4) we believe that we

have a number of meritorious legal defenses. Accordingly, at this time, we are not able to estimate a possible loss or range of

loss that may result from these matters or to determine whether such loss, if any, would have a material adverse effect on our

financial condition, results of operations or liquidity.

We are a defendant in various other lawsuits that arose in the normal course of business. We do not believe that the

eventual resolution of these other lawsuits (either individually or in the aggregate), including any reasonably possible losses in

excess of current accruals, will have a material adverse effect on our financial condition, results of operations or liquidity.

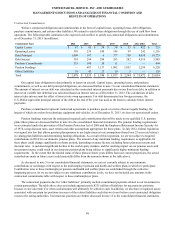

Collective Bargaining Agreements

As of December 31, 2013, we had approximately 253,000 employees employed under a national master agreement and

various supplemental agreements with local unions affiliated with the International Brotherhood of Teamsters (“Teamsters”). In

April 2013, we reached a tentative agreement with the Teamsters on two new national master agreements in the U.S. Domestic

Package and UPS Freight business units, both of which are retroactive to August 1, 2013 and will remain effective through July

31, 2018. Before expiration of the existing national master agreements, the Company and the Teamsters agreed to extensions

of both existing five-year national master agreements and all supplemental agreements. The extensions are open-ended and can

be terminated by either party on thirty days' notice.

UPS Teamster-represented employees in the U.S. Domestic Package business unit subsequently voted to approve the new

national master agreement in June 2013, while several local U.S. Domestic Package supplemental agreements require

additional negotiation and approval before ratification occurs. As of February 2014, there were a total of six supplemental

agreements that still have to be approved before ratification. We anticipate that the remaining agreements will be voted upon in

the coming months.

The UPS Freight business unit ratified its national master agreement in January 2014.

We have approximately 2,600 pilots who are employed under a collective bargaining agreement with the Independent

Pilots Association (“IPA”), which became amendable at the end of 2011. In February 2014, UPS and the IPA requested

mediation by the National Mediation Board for the ongoing contract negotiations. Our airline mechanics are covered by a

collective bargaining agreement with Teamsters Local 2727, which became amendable November 1, 2013. In addition,

approximately 3,100 of our ground mechanics who are not employed under agreements with the Teamsters are employed under

collective bargaining agreements with the International Association of Machinists and Aerospace Workers (“IAM”). Our

agreement with the IAM runs through July 31, 2014.

Tax Matters

In June 2011, we received an IRS Revenue Agent Report ("RAR") covering excise taxes for tax years 2003 through 2007,

in addition to the income tax matters described in note 12 to the consolidated financial statements. The excise tax RAR

proposed two alternate theories for asserting additional excise tax on transportation of property by air. We disagreed with these

proposed excise tax theories and related adjustments. We filed protests and, in the third quarter of 2011, the IRS responded to

our protests and forwarded the case to IRS Appeals.