UPS 2013 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2013 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

106

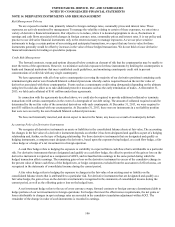

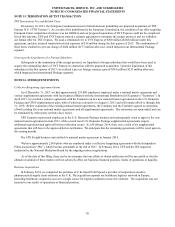

NOTE 14. DERIVATIVE INSTRUMENTS AND RISK MANAGEMENT

Risk Management Policies

We are exposed to market risk, primarily related to foreign exchange rates, commodity prices and interest rates. These

exposures are actively monitored by management. To manage the volatility relating to certain of these exposures, we enter into a

variety of derivative financial instruments. Our objective is to reduce, where it is deemed appropriate to do so, fluctuations in

earnings and cash flows associated with changes in foreign currency rates, commodity prices and interest rates. It is our policy and

practice to use derivative financial instruments only to the extent necessary to manage exposures. As we use price sensitive

instruments to hedge a certain portion of our existing and anticipated transactions, we expect that any loss in value for those

instruments generally would be offset by increases in the value of those hedged transactions. We do not hold or issue derivative

financial instruments for trading or speculative purposes.

Credit Risk Management

The forward contracts, swaps and options discussed below contain an element of risk that the counterparties may be unable to

meet the terms of the agreements. However, we minimize such risk exposures for these instruments by limiting the counterparties to

banks and financial institutions that meet established credit guidelines, and monitoring counterparty credit risk to prevent

concentrations of credit risk with any single counterparty.

We have agreements with all of our active counterparties (covering the majority of our derivative positions) containing early

termination rights and/or zero threshold bilateral collateral provisions whereby cash is required based on the net fair value of

derivatives associated with those counterparties. Events such as a counterparty credit rating downgrade (depending on the ultimate

rating level) could also allow us to take additional protective measures such as the early termination of trades. At December 31,

2013, we held cash collateral of $161 million under these agreements.

In connection with the agreements described above, we could also be required to provide additional collateral or terminate

transactions with certain counterparties in the event of a downgrade of our debt rating. The amount of collateral required would be

determined by the net fair value of the associated derivatives with each counterparty. At December 31, 2013, we were required to

post $35 million in collateral with our counterparties. At December 31, 2013, there were no instruments in a net liability position

that were not covered by the zero threshold bilateral collateral provisions.

We have not historically incurred, and do not expect to incur in the future, any losses as a result of counterparty default.

Accounting Policy for Derivative Instruments

We recognize all derivative instruments as assets or liabilities in the consolidated balance sheets at fair value. The accounting

for changes in the fair value of a derivative instrument depends on whether it has been designated and qualifies as part of a hedging

relationship and, further, on the type of hedging relationship. For those derivative instruments that are designated and qualify as

hedging instruments, a company must designate the derivative, based upon the exposure being hedged, as a cash flow hedge, a fair

value hedge or a hedge of a net investment in a foreign operation.

A cash flow hedge refers to hedging the exposure to variability in expected future cash flows that is attributable to a particular

risk. For derivative instruments that are designated and qualify as a cash flow hedge, the effective portion of the gain or loss on the

derivative instrument is reported as a component of AOCI, and reclassified into earnings in the same period during which the

hedged transaction affects earnings. The remaining gain or loss on the derivative instrument in excess of the cumulative change in

the present value of future cash flows of the hedged item, or hedge components excluded from the assessment of effectiveness, are

recognized in the statements of consolidated income during the current period.

A fair value hedge refers to hedging the exposure to changes in the fair value of an existing asset or liability on the

consolidated balance sheets that is attributable to a particular risk. For derivative instruments that are designated and qualify as a

fair value hedge, the gain or loss on the derivative instrument is recognized in the statements of consolidated income during the

current period, as well as the offsetting gain or loss on the hedged item.

A net investment hedge refers to the use of cross currency swaps, forward contracts or foreign currency denominated debt to

hedge portions of our net investments in foreign operations. For hedges that meet the effectiveness requirements, the net gains or

losses attributable to changes in spot exchange rates are recorded in the cumulative translation adjustment within AOCI. The

remainder of the change in value of such instruments is recorded in earnings.