UPS 2013 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2013 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

81

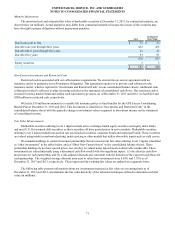

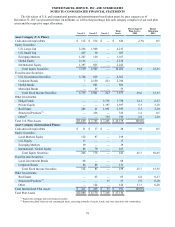

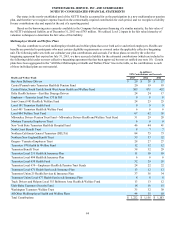

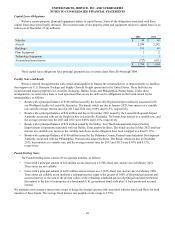

The following table presents the changes in the Level 3 instruments measured on a recurring basis for the years ended

December 31, 2013 and 2012 (in millions). The information presented for 2012 has been revised to include international plan

assets in conformity with the 2013 presentation of international plan assets.

Corporate

Bonds Hedge

Funds Real

Estate Private

Equity Other Total

Balance on January 1, 2012 $ 80 $ 2,132 $ 948 $ 1,354 $ 644 $ 5,158

Actual Return on Assets:

Assets Held at End of Year 1 59 85 163 159 467

Assets Sold During the Year (3) 5 4 — — 6

Purchases 71 1,300 144 184 608 2,307

Sales (11) (667)(142)(285) — (1,105)

Settlements — — — — — —

Transfers Into (Out of) Level 3 — — — — — —

Balance on December 31, 2012 $ 138 $ 2,829 $ 1,039 $ 1,416 $ 1,411 $ 6,833

Actual Return on Assets:

Assets Held at End of Year (1) 229 81 71 (93) 287

Assets Sold During the Year — 5 54 153 54 266

Purchases 165 1,676 145 143 1 2,130

Sales (79) (1,001)(228)(386)(562)(2,256)

Settlements — — — — — —

Transfers Into (Out of) Level 3 — — — — — —

Balance on December 31, 2013 $ 223 $ 3,738 $ 1,091 $ 1,397 $ 811 $ 7,260

There were no UPS class A or B shares of common stock directly held in plan assets as of December 31, 2013 or

December 31, 2012.

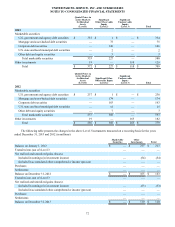

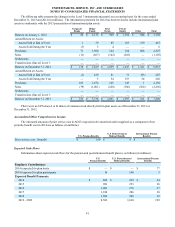

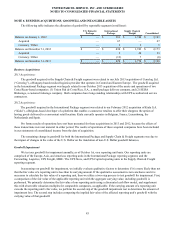

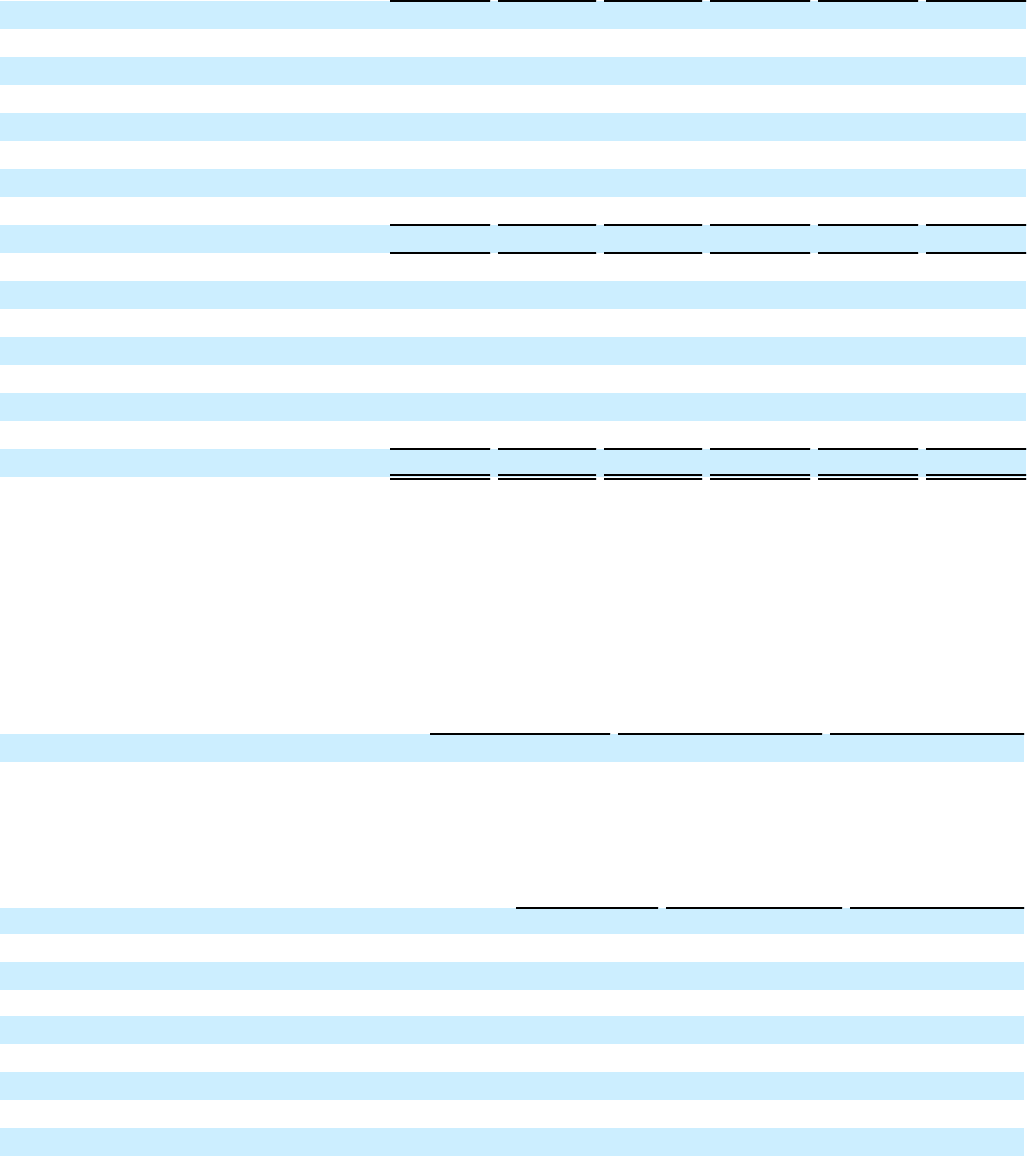

Accumulated Other Comprehensive Income

The estimated amounts of prior service cost in AOCI expected to be amortized and recognized as a component of net

periodic benefit cost in 2014 are as follows (in millions):

U.S. Pension Benefits U.S. Postretirement

Medical Benefits International Pension

Benefits

Prior service cost / (benefit) $ 169 $ 4 $ 1

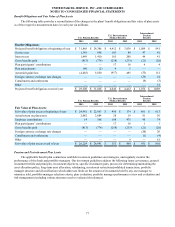

Expected Cash Flows

Information about expected cash flows for the pension and postretirement benefit plans is as follows (in millions):

U.S.

Pension Benefits U.S. Postretirement

Medical Benefits International Pension

Benefits

Employer Contributions:

2014 (expected) to plan trusts $ — $ — $ 77

2014 (expected) to plan participants 16 100 3

Expected Benefit Payments:

2014 $ 885 $ 239 $ 24

2015 981 253 26

2016 1,081 270 27

2017 1,188 286 30

2018 1,306 300 32

2019 - 2023 8,502 1,610 199