UPS 2013 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2013 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

93

In January 2008, a class action complaint was filed in the United States District Court for the Eastern District of New

York alleging price-fixing activities relating to the provision of freight forwarding services. UPS was not named in this case. In

July 2009, the plaintiffs filed a First Amended Complaint naming numerous global freight forwarders as defendants. UPS and

UPS Supply Chain Solutions are among the 60 defendants named in the amended complaint. The plaintiffs filed a Second

Amended Complaint in October 2010, which we moved to dismiss. In August 2012, the Court granted our motion to dismiss

all claims relevant to UPS in the Second Amended Complaint, with leave to amend. The plaintiffs filed a Third Amended

Complaint in November 2012. We filed another motion to dismiss. On September 20, 2013, the Magistrate Judge

recommended to the Court that UPS be dismissed from one of the claims in the Third Amended Complaint, with prejudice, but

recommended that UPS's motion to dismiss with respect to other claims in the Third Amended Complaint be denied. UPS and

other defendants filed objections to the recommendations of the Magistrate Judge to the extent they recommended denial of

UPS's motion to dismiss. Those objections are currently pending before the Court. There are multiple factors that prevent us

from being able to estimate the amount of loss, if any, that may result from these matters including: (1) the Court's pending

review of the adequacy of the Third Amended Complaint; (2) the scope and size of the proposed class is ill-defined; (3) there

are significant legal questions about the adequacy and standing of the putative class representatives; and (4) we believe that we

have a number of meritorious legal defenses. Accordingly, at this time, we are not able to estimate a possible loss or range of

loss that may result from these matters or to determine whether such loss, if any, would have a material adverse effect on our

financial condition, results of operations or liquidity.

We are a defendant in various other lawsuits that arose in the normal course of business. We do not believe that the

eventual resolution of these other lawsuits (either individually or in the aggregate), including any reasonably possible losses in

excess of current accruals, will have a material adverse effect on our financial condition, results of operations or liquidity.

Tax Matters

In June 2011, we received an IRS Revenue Agent Report ("RAR") covering excise taxes for tax years 2003 through 2007,

in addition to the income tax matters described in note 12 to the consolidated financial statements. The excise tax RAR

proposed two alternate theories for asserting additional excise tax on transportation of property by air. We disagreed with these

proposed excise tax theories and related adjustments. We filed protests and, in the third quarter of 2011, the IRS responded to

our protests and forwarded the case to IRS Appeals.

Beginning in the third quarter of 2012 and continuing through the first quarter of 2013, we had settlement discussions

with the Appeals team. In the first quarter of 2013, we reached settlement terms for a complete resolution of all excise tax

matters and correlative income tax refund claims for the 2003 through 2007 tax years. The final resolution of these matters did

not materially impact our financial condition, results of operations or liquidity.

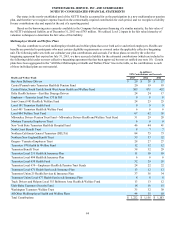

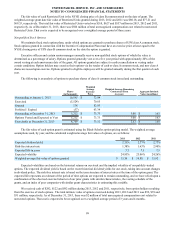

NOTE 9. SHAREOWNERS’ EQUITY

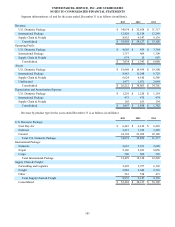

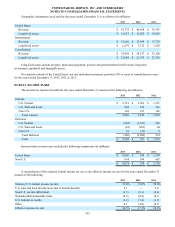

Capital Stock, Additional Paid-In Capital, and Retained Earnings

We maintain two classes of common stock, which are distinguished from each other by their respective voting rights.

Class A shares of UPS are entitled to 10 votes per share, whereas class B shares are entitled to one vote per share. Class A

shares are primarily held by UPS employees and retirees, as well as trusts and descendants of the Company’s founders, and

these shares are fully convertible into class B shares at any time. Class B shares are publicly traded on the New York Stock

Exchange (“NYSE”) under the symbol “UPS.” Class A and B shares both have a $0.01 par value, and as of December 31, 2013,

there were 4.6 billion class A shares and 5.6 billion class B shares authorized to be issued. Additionally, there are 200 million

preferred shares authorized to be issued, with a par value of $0.01 per share; as of December 31, 2013, no preferred shares had

been issued.