UPS 2013 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2013 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

95

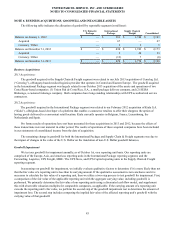

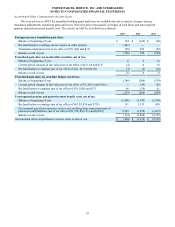

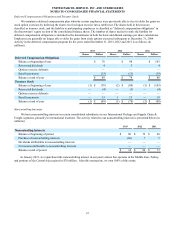

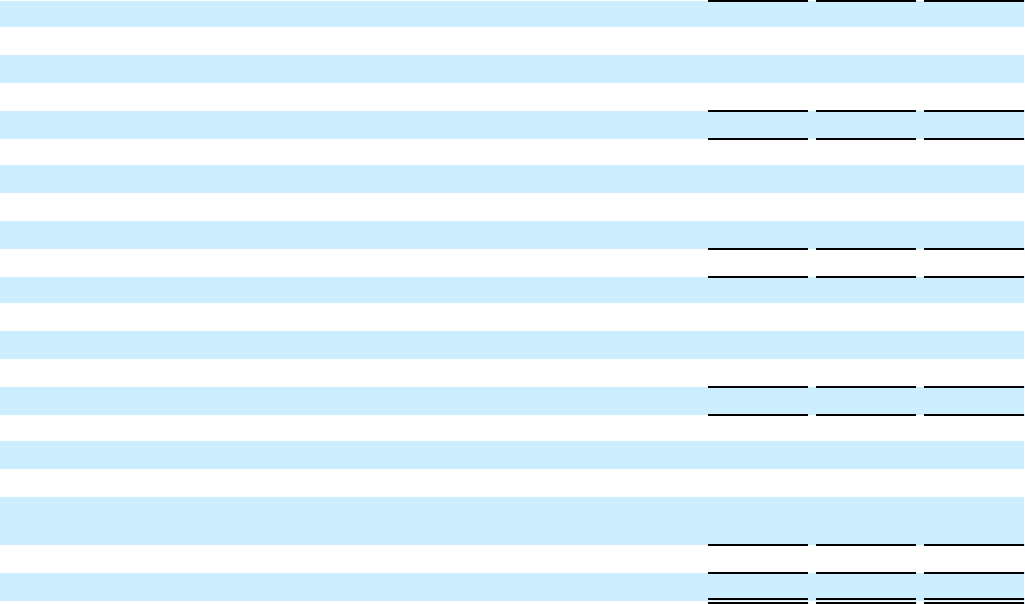

Accumulated Other Comprehensive Income (Loss)

We incur activity in AOCI for unrealized holding gains and losses on available-for-sale securities, foreign currency

translation adjustments, unrealized gains and losses from derivatives that qualify as hedges of cash flows and unrecognized

pension and postretirement benefit costs. The activity in AOCI is as follows (in millions):

2013 2012 2011

Foreign currency translation gain (loss):

Balance at beginning of year $ 134 $ (160) $ (68)

Reclassification to earnings (no tax impact in either period) (161) — —

Translation adjustment (net of tax effect of $(5), $(9) and $11) (99) 294 (92)

Balance at end of year (126) 134 (160)

Unrealized gain (loss) on marketable securities, net of tax:

Balance at beginning of year 6 6 12

Current period changes in fair value (net of tax effect of $(3), $4 and $11) (4) 6 18

Reclassification to earnings (net of tax effect of $(2), $(3) and $(14)) (3)(6)(24)

Balance at end of year (1) 6 6

Unrealized gain (loss) on cash flow hedges, net of tax:

Balance at beginning of year (286)(204)(239)

Current period changes in fair value (net of tax effect of $1, $(25) and $(16)) 1 (43)(26)

Reclassification to earnings (net of tax effect of $39, $(24) and $37) 66 (39) 61

Balance at end of year (219)(286)(204)

Unrecognized pension and postretirement benefit costs, net of tax:

Balance at beginning of year (3,208)(2,745)(2,340)

Reclassification to earnings (net of tax effect of $67, $1,876 and $378) 111 3,135 628

Net actuarial gain (loss) and prior service cost resulting from remeasurements of

plan assets and liabilities (net of tax effect of $1,786, $(2,151) and $(622)) 2,983 (3,598)(1,033)

Balance at end of year (114)(3,208)(2,745)

Accumulated other comprehensive income (loss) at end of year $ (460) $ (3,354) $ (3,103)