UPS 2013 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2013 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

The U.S. economic expansion continued at a slow to moderate pace in 2013. Continued growth in retail sales

(particularly among e-commerce retailers) has provided for expansion in the overall U.S. small package delivery market;

however, slowing export growth and industrial production have negatively impacted the growth in commercial shipments.

Given these trends, our products most aligned with business-to-consumer shipments have experienced the strongest growth,

while growth in our business-to-business volume has remained sluggish. This trend was particularly accentuated during the

holiday season, when strong e-commerce growth was experienced during the compressed holiday shopping period.

Outside of the U.S., economic growth has remained slow largely due to fiscal austerity measures, particularly in Europe.

This slower economic growth has created an environment in which customers are more likely to trade-down from premium

express products to standard delivery products in both Europe and Asia. Additionally, the uneven nature of economic growth

worldwide, combined with the trend towards more international trade being conducted regionally, has led to shifting trade

patterns and resulted in overcapacity in certain trade lanes. These circumstances have led us to adjust our air capacity and cost

structure in our transportation network to match the prevailing volume mix levels. Our broad portfolio of product offerings and

the flexibilities inherent in our transportation network have helped us adapt to these changing trends.

While the worldwide economic environment remained challenging in 2013, we have continued to undertake initiatives to

improve yield management, increase operational efficiency and contain costs across all segments. Continued deployment of

technology improvements should lead to further gains in our operational efficiency, improve network flexibility and capacity,

and enhance service reliability, thus restraining cost increases and improving margins. In our International Package segment,

we have adjusted our transportation network and utilized newly expanded operating facilities to improve time-in-transit for

shipments in each region. We have also continued to leverage the new air route authority we have gained over the last several

years and to take full advantage of faster growing trade lanes.

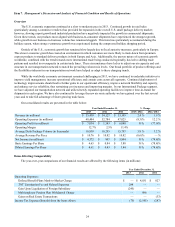

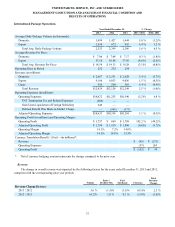

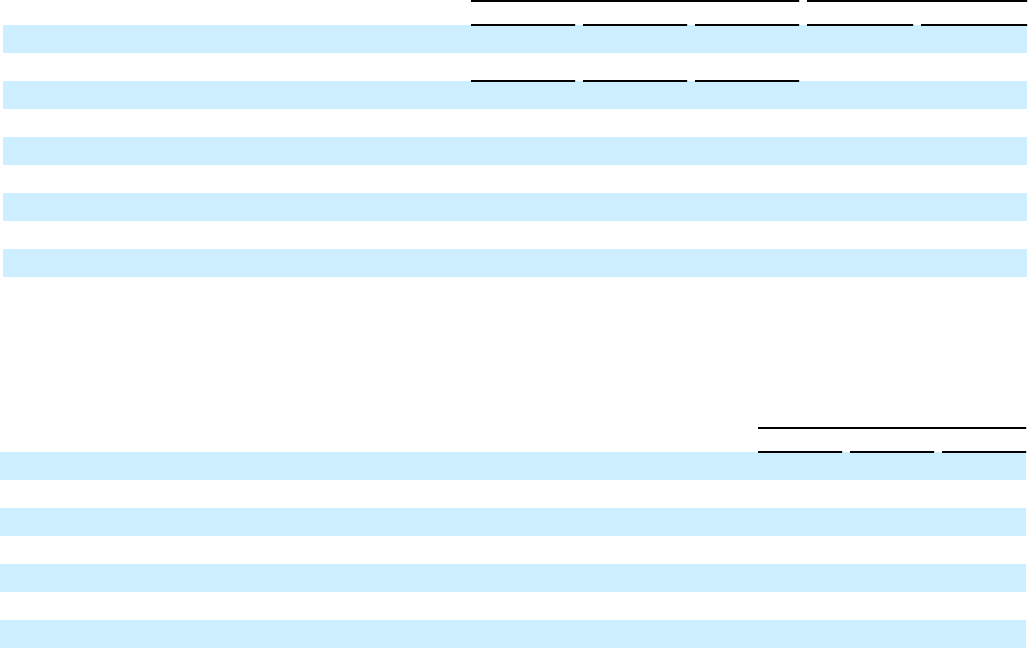

Our consolidated results are presented in the table below:

Year Ended December 31, % Change

2013 2012 2011 2013 / 2012 2012 / 2011

Revenue (in millions) $ 55,438 $ 54,127 $ 53,105 2.4 % 1.9 %

Operating Expenses (in millions) 48,404 52,784 47,025 (8.3)% 12.2 %

Operating Profit (in millions) $ 7,034 $ 1,343 $ 6,080 N/A (77.9)%

Operating Margin 12.7% 2.5% 11.4%

Average Daily Package Volume (in thousands) 16,938 16,295 15,797 3.9 % 3.2 %

Average Revenue Per Piece $ 10.76 $ 10.82 $ 10.82 (0.6)% — %

Net Income (in millions) $ 4,372 $ 807 $ 3,804 N/A (78.8)%

Basic Earnings Per Share $ 4.65 $ 0.84 $ 3.88 N/A (78.4)%

Diluted Earnings Per Share $ 4.61 $ 0.83 $ 3.84 N/A (78.4)%

Items Affecting Comparability

The year-over-year comparisons of our financial results are affected by the following items (in millions):

Year Ended December 31,

2013 2012 2011

Operating Expenses:

Defined Benefit Plans Mark-to-Market Charge $ — $ 4,831 $ 827

TNT Termination Fee and Related Expenses 284 — —

Gain Upon Liquidation of Foreign Subsidiary (245) — —

Multiemployer Pension Plan Withdrawal Charge — 896 —

Gains on Real Estate Transactions — — (33)

Income Tax Expense (Benefit) from the Items Above (75)(2,145)(287)