UPS 2010 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2010 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

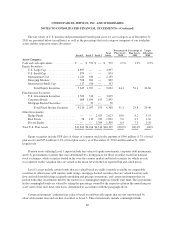

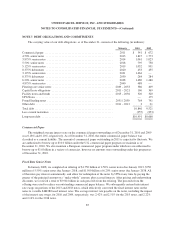

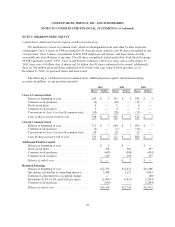

NOTE 7. DEBT OBLIGATIONS AND COMMITMENTS

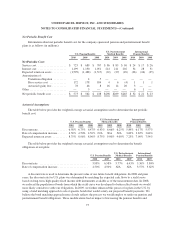

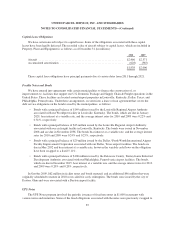

The carrying value of our debt obligations, as of December 31, consists of the following (in millions):

Maturity 2010 2009

Commercial paper ................................................ 2011 $ 341 $ 672

4.50% senior notes ............................................... 2013 1,815 1,773

3.875% senior notes .............................................. 2014 1,061 1,023

5.50% senior notes ............................................... 2018 795 758

5.125% senior notes .............................................. 2019 1,032 991

8.375% debentures ............................................... 2020 453 455

3.125% senior notes .............................................. 2021 1,464 —

8.375% debentures ............................................... 2030 284 284

6.20% senior notes ............................................... 2038 1,480 1,480

4.875% senior notes .............................................. 2040 488 —

Floating rate senior notes .......................................... 2049 – 2053 386 409

Capital lease obligations ........................................... 2011 – 2021 160 369

Facility notes and bonds ........................................... 2015 – 2036 320 320

UPS Notes ...................................................... — 175

Pound Sterling notes .............................................. 2031 / 2050 764 791

Other debt ...................................................... 2011 – 2012 3 21

Total debt ....................................................... 10,846 9,521

Less current maturities ............................................ (355) (853)

Long-term debt .................................................. $10,491 $8,668

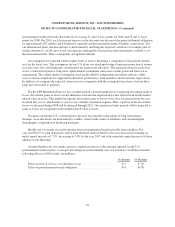

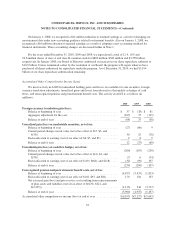

Commercial Paper

The weighted average interest rate on the commercial paper outstanding as of December 31, 2010 and 2009

was 0.18% and 0.10%, respectively. As of December 31, 2010, the entire commercial paper balance was

classified as a current liability. The amount of commercial paper outstanding in 2011 is expected to fluctuate. We

are authorized to borrow up to $10.0 billion under the U.S. commercial paper program we maintain as of

December 31, 2010. We also maintain a European commercial paper program under which we are authorized to

borrow up to €1.0 billion in a variety of currencies, however no amounts were outstanding under this program as

of December 31, 2010.

Fixed Rate Senior Notes

In January 2008, we completed an offering of $1.750 billion of 4.50% senior notes due January 2013, $750

million of 5.50% senior notes due January 2018, and $1.500 billion of 6.20% senior notes due January 2038. All

of the notes pay interest semiannually, and allow for redemption of the notes by UPS at any time by paying the

greater of the principal amount or a “make-whole” amount, plus accrued interest. After pricing and underwriting

discounts, we received a total of $3.961 billion in cash proceeds from the offering. The proceeds from the

offering were used to reduce our outstanding commercial paper balance. We subsequently entered into interest

rate swaps on portions of the 2013 and 2018 notes, which effectively converted the fixed interest rates on the

notes to variable LIBOR-based interest rates. The average interest rate payable on the notes, including the impact

of the interest rate swaps, for 2010 and 2009, respectively, was 2.42% and 2.51% for the 2013 notes, and 2.22%

and 2.16% for the 2018 notes.

85