UPS 2010 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2010 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

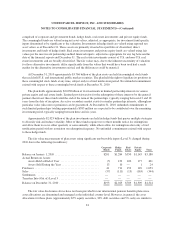

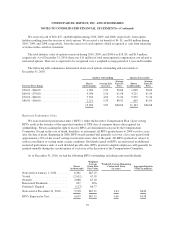

As of December 31, 2010, we had outstanding letters of credit totaling approximately $1.580 billion issued

in connection with our self-insurance reserves and other routine business requirements. We also issue surety

bonds as an alternative to letters of credit in certain instances, and as of December 31, 2010, we had $577 million

of surety bonds written.

Available Credit

We maintain two credit agreements with a consortium of banks. One of these agreements provides revolving

credit facilities of $1.5 billion, and expires on April 14, 2011. Interest on any amounts we borrow under this

facility would be charged at 90-day LIBOR plus a percentage determined by quotations from Markit Group Ltd.

for our 1-year credit default swap spread, subject to certain minimum rates and maximum rates based on our

public debt ratings from Standard & Poor’s and Moody’s. If our public debt ratings are A / A2 or above, the

minimum applicable margin is 0.50% and the maximum applicable margin is 1.50%; if our public debt ratings

are lower than A / A2, the minimum applicable margin is 1.00% and the maximum applicable margin is 2.50%.

The second agreement provides revolving credit facilities of $1.0 billion, and expires on April 19, 2012.

Interest on any amounts we borrow under this facility would be charged at 90-day LIBOR plus 15 basis points.

At December 31, 2010, there were no outstanding borrowings under either of these facilities.

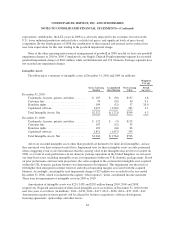

Our existing debt instruments and credit facilities do not have cross-default or ratings triggers, however

these debt instruments and credit facilities do subject us to certain financial covenants. As of December 31, 2010

and for all prior periods presented, we have satisfied these financial covenants. These covenants limit the amount

of secured indebtedness that we may incur, and limit the amount of attributable debt in sale-leaseback

transactions, to 10% of net tangible assets. As of December 31, 2010, 10% of net tangible assets is equivalent to

$2.501 billion, however we have no covered sale-leaseback transactions or secured indebtedness outstanding.

Additionally, we are required to maintain a minimum net worth, as defined, of $5.0 billion on a quarterly basis.

As of December 31, 2010, our net worth, as defined, was equivalent to $14.174 billion. We do not expect these

covenants to have a material impact on our financial condition or liquidity.

Fair Value of Debt

Based on the borrowing rates currently available to the Company for long-term debt with similar terms and

maturities, the fair value of long-term debt, including current maturities, is approximately $11.355 and $10.216

billion as of December 31, 2010 and 2009, respectively.

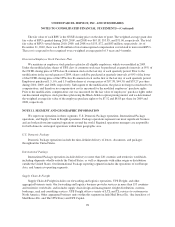

NOTE 8. LEGAL PROCEEDINGS AND CONTINGENCIES

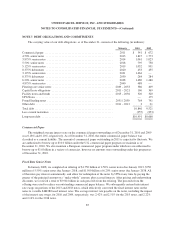

We are a defendant in a number of lawsuits filed in state and federal courts containing various class action

allegations under state wage-and-hour laws. In one of these cases, Marlo v. UPS, which was certified as a class

action in a California federal court in September 2004, plaintiffs allege that they improperly were denied

overtime, and seek penalties for missed meal and rest periods, and interest and attorneys’ fees. Plaintiffs purport

to represent a class of 1,300 full-time supervisors. In August 2005, the court granted summary judgment in favor

of UPS on all claims, and plaintiffs appealed the ruling. In October 2007, the appeals court reversed the lower

court’s ruling. In April 2008, the Court decertified the class and vacated the trial scheduled for that month. After

decertification, some plaintiffs filed individual lawsuits raising the same allegations as in the underlying class

action. These individual lawsuits are in various stages. We have denied any liability with respect to these claims

and intend to vigorously defend ourselves in these cases. At this time, we have not determined the amount of any

liability that may result from these matters or whether such liability, if any, would have a material adverse effect

on our financial condition, results of operations, or liquidity.

89