UPS 2010 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2010 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities

Our class A common stock is not listed on a national securities exchange or traded in an organized

over-the-counter market, but each share of our class A common stock is convertible into one share of our class B

common stock.

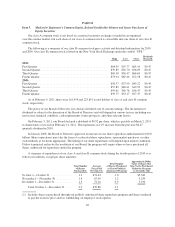

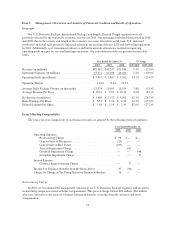

The following is a summary of our class B common stock price activity and dividend information for 2010

and 2009. Our class B common stock is listed on the New York Stock Exchange under the symbol “UPS.”

High Low Close

Dividends

Declared

2010:

First Quarter ................................................. $64.95 $55.77 $64.41 $0.47

Second Quarter ............................................... $70.89 $56.70 $56.89 $0.47

Third Quarter ................................................ $69.50 $56.47 $66.69 $0.47

Fourth Quarter ............................................... $73.94 $65.44 $72.58 $0.47

2009:

First Quarter ................................................. $56.37 $37.99 $49.22 $0.45

Second Quarter ............................................... $57.89 $46.41 $49.99 $0.45

Third Quarter ................................................ $59.61 $46.78 $56.47 $0.45

Fourth Quarter ............................................... $59.75 $53.17 $57.37 $0.45

As of February 9, 2011, there were 161,954 and 223,891 record holders of class A and class B common

stock, respectively.

The policy of our Board of Directors is to declare dividends out of current earnings. The declaration of

dividends is subject to the discretion of the Board of Directors and will depend on various factors, including our

net income, financial condition, cash requirements, future prospects, and other relevant factors.

On February 3, 2011, our Board declared a dividend of $0.52 per share, which is payable on March 2, 2011

to shareowners of record on February 14, 2011. This represents an 11% increase from the previous $0.47

quarterly dividend in 2010.

In January 2008, the Board of Directors approved an increase in our share repurchase authorization to $10.0

billion. Share repurchases may take the form of accelerated share repurchases, open market purchases, or other

such methods as we deem appropriate. The timing of our share repurchases will depend upon market conditions.

Unless terminated earlier by the resolution of our Board, the program will expire when we have purchased all

shares authorized for repurchase under the program.

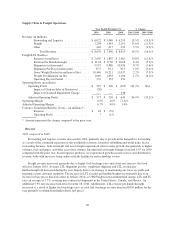

A summary of repurchases of our class A and class B common stock during the fourth quarter of 2010 is as

follows (in millions, except per share amounts):

Total Number

of Shares

Purchased(1)

Average

Price Paid

Per Share(1)

Total Number

of Shares Purchased

as Part of Publicly

Announced Program

Approximate Dollar

Value of Shares that

May Yet be Purchased

Under the Program

(as of month-end)

October 1—October 31 .............. 1.2 $74.43 1.0 $5,342

November 1—November 30 .......... 1.4 67.09 1.2 5,259

December 1—December 31 ........... 1.3 72.16 0.9 5,194

Total October 1—December 31 .... 3.9 $70.86 3.1

(1) Includes shares repurchased through our publicly announced share repurchase program and shares tendered

to pay the exercise price and tax withholding on employee stock options.

20