UPS 2010 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2010 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The actual amounts that will be reclassified to income over the next 12 months will vary from this amount as a

result of changes in market conditions. The amount of ineffectiveness recognized in income on derivative

instruments designated in cash flow hedging relationships was immaterial for the years ended December 31,

2010, 2009 and 2008.

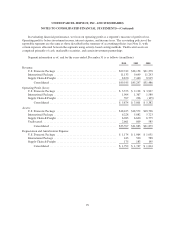

The following table indicates the amount and location in the income statement in which derivative gains and

losses, as well as the associated gains and losses on the underlying exposure, have been recognized for those

derivatives designated as fair value hedges for the years ended December 31, 2010 and 2009 (in millions):

Derivative Instruments in

Fair Value Hedging

Relationships

Location of

Gain (Loss)

Recognized in

Income

2010

Amount of

Gain

(Loss)

Recognized

in Income

2009

Amount of

Gain

(Loss)

Recognized

in Income

Hedged Items in

Fair Value Hedging

Relationships

Location of Gain

(Loss)

Recognized in

Income

2010

Amount of

Gain

(Loss)

Recognized

in Income

2009

Amount of

Gain

(Loss)

Recognized

in Income

Interest rate contracts ....Interest Expense $134 $68 Fixed-Rate Debt

and Capital Leases

Interest Expense $(134) $(68)

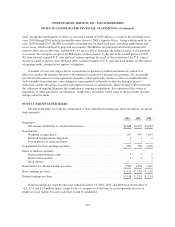

Additionally, we maintain some interest rate swap and foreign exchange forward contracts that are not

designated as hedges. These interest rate swap contracts are intended to provide an economic hedge of a portfolio

of interest bearing receivables, however the income statement impact of these hedges was not material for any

period presented. These foreign exchange forward contracts are intended to provide an economic offset to foreign

currency remeasurement risks for certain assets and liabilities in our balance sheet. The following is a summary

of the amounts recorded in the statements of consolidated income related to fair value changes and settlements of

these foreign currency forward contracts not designated as hedges for the years ended December 31, 2010 and

2009 (in millions):

Derivative Instruments Not Designated in

Hedging Relationships

Location of Gain

(Loss) Recognized

in Income

2010 Amount

of Gain

(Loss)

Recognized in

Income

2009 Amount

of Gain

(Loss)

Recognized in

Income

Foreign Exchange Contracts ...................... Other Operating Expenses $13 $(15)

109