UPS 2010 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2010 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

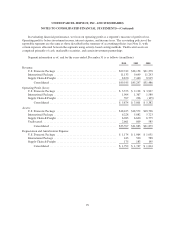

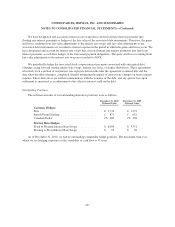

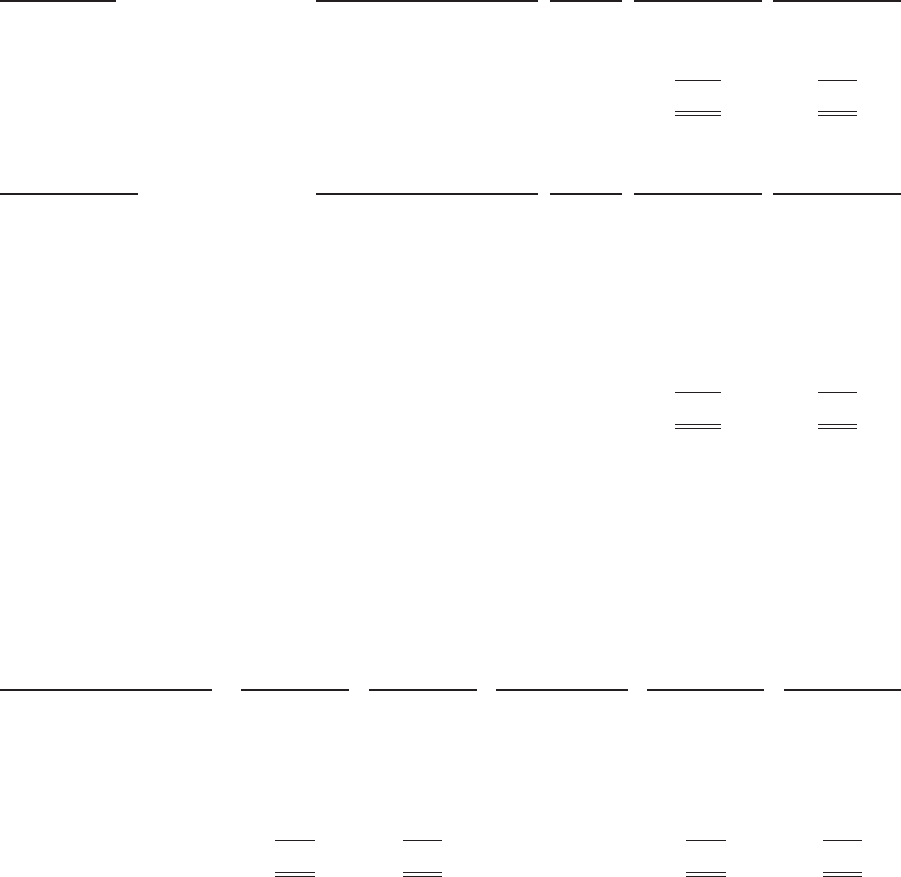

Balance Sheet Recognition

The following table indicates the location on the balance sheet in which our derivative assets and liabilities

have been recognized, and the related fair values of those derivatives (in millions). The table is segregated

between those derivative instruments that qualify and are designated as hedging instruments and those that are

not, as well as by type of contract and whether the derivative is in an asset or liability position.

Asset Derivatives Balance Sheet Location

Fair Value

Hierarchy

Level

December 31, 2010

Fair Value

December 31, 2009

Fair Value

Derivatives designated as hedges:

Foreign exchange contracts ........ Other current assets Level 2 $ 36 $ 63

Interest rate contracts ............. Other non-current assets Level 2 182 74

Total Asset Derivatives ....... $218 $137

Liability Derivatives Balance Sheet Location

Fair Value

Hierarchy

Level

December 31, 2010

Fair Value

December 31, 2009

Fair Value

Derivatives designated as hedges:

Foreign exchange contracts ........ Other current liabilities Level 2 $ (9) $—

Foreign exchange contracts ........ Other non-current liabilities Level 2 (99) (51)

Interest rate contracts ............. Other non-current liabilities Level 2 (29) (13)

Derivatives not designated as

hedges:

Interest rate contracts ............. Other non-current liabilities Level 2 (1) (2)

Foreign exchange contracts ........ Other current liabilities Level 2 (3) —

Total Liability Derivatives ..... $(141) $ (66)

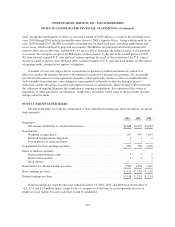

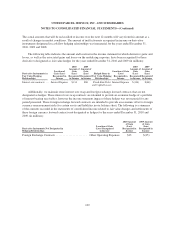

Income Statement Recognition

The following table indicates the amount and location in the income statement in which derivative gains and

losses, as well as the related amounts reclassified from AOCI, have been recognized for those derivatives

designated as cash flow hedges for the years ended December 31, 2010 and 2009 (in millions):

Derivative Instruments in Cash

Flow Hedging Relationships

2010 Amount of

Gain (Loss)

Recognized in

OCI on

Derivative

(Effective

Portion)

2009 Amount of

Gain (Loss)

Recognized in

OCI on

Derivative

(Effective

Portion)

Location of Gain

(Loss) Reclassified

from Accumulated

OCI into Income

(Effective Portion)

2010 Amount of

Gain (Loss)

Reclassified from

Accumulated

OCI into Income

(Effective

Portion)

2009 Amount of

Gain (Loss)

Reclassified from

Accumulated

OCI into Income

(Effective

Portion)

Interest rate contracts ..... $ 7 $127 Interest Expense $ (18) $ (15)

Foreign exchange

contracts ............. (48) (42) Interest Expense (27) (4)

Foreign exchange

contracts ............. 30 (75) Revenue 96 96

Commodity contracts ..... — — Revenue — 82

Total .............. $(11) $ 10 $ 51 $159

As of December 31, 2010, $55 million of pre-tax losses related to cash flow hedges that are currently

deferred in AOCI are expected to be reclassified to income over the 12 month period ended December 31, 2011.

108