UPS 2010 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2010 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We may not realize the anticipated benefits of acquisitions, joint ventures or strategic alliances.

As part of our business strategy, we may acquire businesses and form joint ventures or strategic alliances.

Whether we realize the anticipated benefits from these transactions depends, in part, upon the successful

integration between the businesses involved, the performance of the underlying operation, capabilities or

technologies and the management of the transacted operations. Accordingly, our financial results could be

adversely affected by our failure to effectively integrate the acquired operations, unanticipated performance

issues, transaction-related charges, or charges for impairment of long-term assets that we acquire.

Insurance and claims expenses could have a material adverse effect on our business, financial condition and

results of operations.

We have a combination of both self-insurance and high-deductible insurance programs for the risks arising

out of the services we provide and the nature of our global operations, including claims exposure resulting from

cargo loss, personal injury, property damage, aircraft and related liabilities, business interruption and workers’

compensation. Workers’ compensation, automobile and general liabilities are determined using actuarial

estimates of the aggregate liability for claims incurred and an estimate of incurred but not reported claims, on an

undiscounted basis. Our accruals for insurance reserves reflect certain actuarial assumptions and management

judgments, which are subject to a high degree of variability. If the number or severity of claims for which we are

retaining risk increases, our financial condition and results of operations could be adversely affected. If we lose

our ability to self-insure these risks, our insurance costs could materially increase and we may find it difficult to

obtain adequate levels of insurance coverage.

Item 1B. Unresolved Staff Comments

Not applicable.

Item 2. Properties

Operating Facilities

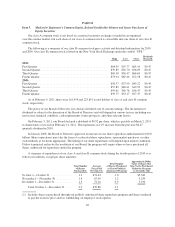

We own our headquarters, which are located in Atlanta, Georgia and consist of about 735,000 square feet of

office space on an office campus, and our UPS Supply Chain Solutions group’s headquarters, which are located

in Alpharetta, Georgia, and consist of about 310,000 square feet of office space.

We also own our 27 principal U.S. package operating facilities, which have floor spaces that range from

about 310,000 to 693,000 square feet. In addition, we have a 1.9 million square foot operating facility near

Chicago, Illinois, which is designed to streamline shipments between East Coast and West Coast destinations,

and we own or lease over 1,000 additional smaller package operating facilities in the U.S. The smaller of these

facilities have vehicles and drivers stationed for the pickup of packages and facilities for the sorting, transfer and

delivery of packages. The larger of these facilities also service our vehicles and equipment and employ

specialized mechanical installations for the sorting and handling of packages.

We own or lease almost 600 facilities that support our international package operations and an additional

776 facilities that support our freight forwarding and logistics operations. Our freight forwarding and logistics

operations maintain facilities with about 31 million square feet of floor space. We own and operate a logistics

campus consisting of approximately 3.1 million square feet in Louisville, Kentucky.

UPS Freight operates 196 service centers with a total of 5.6 million square feet of floor space. UPS Freight

owns 140 of these service centers, while the remainder are occupied under operating lease agreements. The main

offices of UPS Freight are located in Richmond, Virginia and consist of about 240,000 square feet of office

space.

16