UPS 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

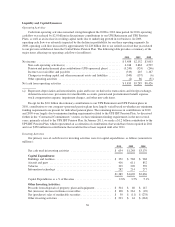

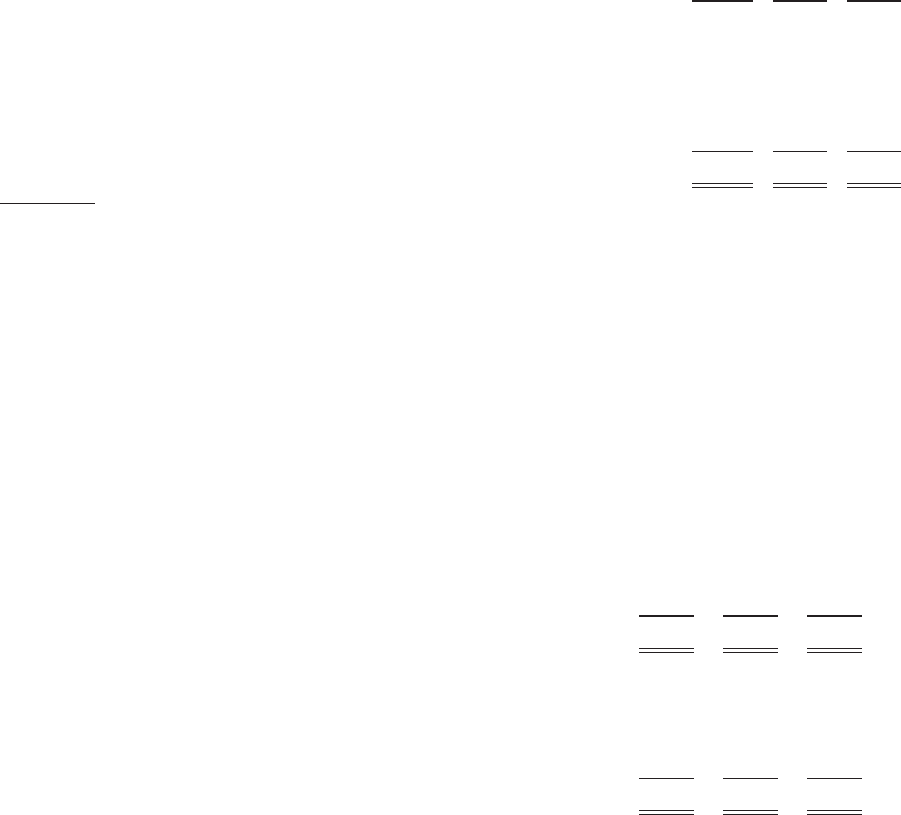

Liquidity and Capital Resources

Operating Activities

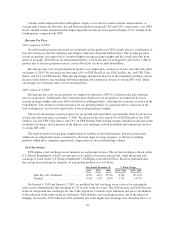

Cash from operating activities remained strong throughout the 2008 to 2010 time period. In 2010, operating

cash flow was reduced by $2.0 billion in discretionary contributions to our UPS Retirement and UPS Pension

Plans, as well as an increase in working capital needs due to underlying growth in our business. In 2009,

operating cash flow was adversely impacted by the decline in profitability for our three reporting segments. In

2008, operating cash flow increased by approximately $1.228 billion due to tax refunds received that year related

to our previous withdrawal from the Central States Pension Plan. The following table provides a summary of the

major items affecting our operating cash flows (in millions):

2010 2009 2008

Net income .......................................................... $3,488 $2,152 $3,003

Non-cash operating activities(a) ...................................... 4,248 3,863 4,539

Pension and postretirement plan contributions (UPS-sponsored plans) ........ (3,240) (924) (246)

Income tax receivables and payables .................................. (319) 245 1,167

Changes in working capital and other noncurrent assets and liabilities ........ (340) (137) (6)

Other operating activities ........................................... (2) 86 (31)

Net cash from operating activities ........................................ $3,835 $5,285 $8,426

(a) Represents depreciation and amortization, gains and losses on derivative transactions and foreign exchange,

deferred income taxes, provisions for uncollectible accounts, pension and postretirement benefit expense,

stock compensation expense, impairment charges, and other non-cash items.

Except for the $2.0 billion discretionary contributions to our UPS Retirement and UPS Pension plans in

2010, contributions to our company-sponsored pension plans have largely varied based on whether any minimum

funding requirements are present for individual pension plans. The remaining increases in contributions in 2010

and 2009 were largely due to minimum funding requirements related to the UPS IBT Pension Plan. As discussed

further in the “Contractual Commitments” section, we have minimum funding requirements in the next several

years, primarily related to the UPS IBT Pension Plan. In January 2011, we made a $1.2 billion contribution to the

UPS IBT Pension Plan, which represented an acceleration of contributions that would have been required in 2011

and over $350 million in contributions that would not have been required until after 2011.

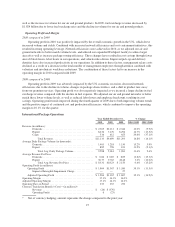

Investing Activities

Our primary uses of cash flows for investing activities were for capital expenditures, as follows (amounts in

millions):

2010 2009 2008

Net cash used in investing activities ............................ $ 654 $1,248 $3,179

Capital Expenditures:

Buildings and facilities ....................................... $ 352 $ 568 $ 968

Aircraft and parts ........................................... 416 611 852

Vehicles .................................................. 339 209 539

Information technology ...................................... 282 214 277

$1,389 $1,602 $2,636

Capital Expenditures as a % of Revenue ......................... 2.8% 3.5% 5.1%

Other Investing Activities:

Proceeds from disposals of property, plant and equipment ........... $ 304 $ 60 $ 147

Net (increase) decrease in finance receivables ..................... $ 108 $ 261 $ (49)

Net (purchases) sales of marketable securities ..................... $ 30 $ (11) $ (278)

Other investing activities ..................................... $ 293 $ 44 $ (363)

36