UPS 2010 Annual Report Download - page 45

Download and view the complete annual report

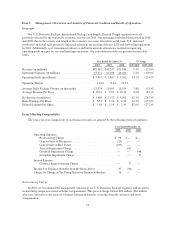

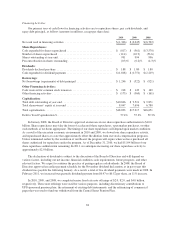

Please find page 45 of the 2010 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Benefits expense increased in 2010, due largely to increases in pension expense, health and welfare expense,

and relocation-related benefit costs for management employees. Pension expense increases resulted primarily

from higher union contribution rates for multi-employer pension plans. The relocation benefit costs relate to the

restructuring of our domestic package operations that occurred in the first quarter of 2010. This increase in health

and welfare costs, which was primarily driven by health cost inflation, was somewhat mitigated by reductions in

the total number of management employees and union employees covered by UPS-sponsored health and welfare

benefit plans.

The decrease in compensation and benefits expense during 2009 compared with 2008 was impacted by

several items. A large component of this decrease was related to employee payroll costs, as union labor hours

declined as a result of lower U.S. Domestic Package volume, and management payroll declined as a result of a

reduction in the total number of management employees through attrition combined with a wage freeze. Benefits

expense increased due to higher employee health and welfare program costs, which were impacted by higher

union contribution rates, and increased pension expense. Pension expense increases resulted from higher union

contribution rates for multi-employer pension plans, combined with increased interest costs, a decrease in our

expected return on plan assets and the amortization of actuarial losses for company-sponsored plans. The interest

cost grew due to continued service accruals, while the decrease in expected return on plan assets and the actuarial

losses were primarily due to the negative asset returns experienced in 2008. The overall increase in benefits

expense was partially offset by a freeze in the company contributions to our primary employee defined

contribution savings plan.

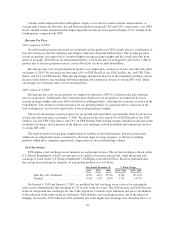

Repairs and Maintenance

Repairs and maintenance expense increased in 2010, largely due to higher costs for maintenance on our

vehicle fleet. Repairs and maintenance expense declined in 2009, largely due to reduced vehicle maintenance

expenses resulting from a reduction in miles driven.

Depreciation and Amortization

Depreciation and amortization expense increased in 2010, primarily as a result of depreciation expense on

equipment and facilities capitalized in conjunction with the recent Worldport expansion. Amortization of

intangible assets also increased as a result of new intangibles recognized related to the Unsped acquisition in

Turkey in the third quarter of 2009, as well as corporate sponsorships entered into in 2010.

Depreciation and amortization expense decreased in 2009, primarily as a result of lower depreciation

expense on equipment and facilities, as certain Worldport assets became fully depreciated, as well as lower

software amortization resulting from fewer new capitalized software projects. These decreases were partially

offset by higher depreciation expense on aircraft and vehicles, resulting from new deliveries in 2008 and 2009.

Purchased Transportation

The increase in purchased transportation in 2010 was driven by higher freight forwarding volume and rates

in Asia and Europe, as well as increased fuel surcharge rates charged to us by third-party carriers as a result of

higher fuel prices. The decrease in purchased transportation in 2009 was driven by a combination of lower

volume in our international package and forwarding businesses, a stronger U.S. Dollar, and decreased fuel

surcharge rates charged to us by third-party carriers as a result of lower fuel prices.

Fuel

The increase in fuel expense in 2010 was caused primarily by higher prices for jet-A fuel, diesel, and

unleaded gasoline, as well as a slight increase in usage of these products in our operations. The decrease in fuel

expense in 2009 was impacted by significantly lower prices for jet-A fuel, diesel, and unleaded gasoline, as well

as lower usage of these products in our operations.

33