UPS 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

•Acceptable Risk—Payments are current, and no loss is likely.

•Sub-Standard Risk—In default or high probability of default, but loss is unlikely.

•Classified—In default, loss is probable, specific allowance for loss is assigned.

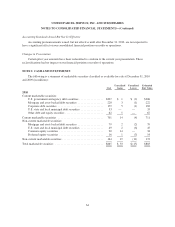

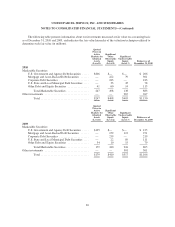

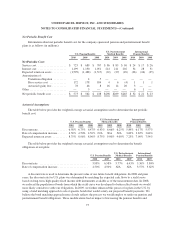

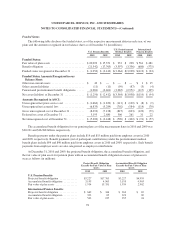

The following is an allocation of the finance receivables portfolio by risk rating category as of

December 31, 2010 (in millions):

Commercial

Lending

Other

Financing

Receivables Total

U.S. Government guaranteed ......................................... $ 98 $— $ 98

Acceptable risk .................................................... 145 235 380

Sub-standard risk .................................................. 12 5 17

Classified ........................................................ 11 5 16

$266 $245 $511

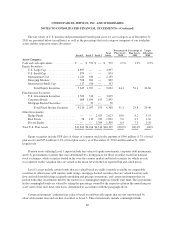

The following is an aging analysis of our finance receivables as of December 31, 2010 (in millions):

30-59 Days

Past Due

60-90 Days

Past Due

Greater

than 90

Days Past

Due Current

Total

Finance

Receivables

Commercial term loans:

U.S. Government guaranteed .................. $ 2 $ 2 $63 $ 31 $ 98

Other unguaranteed .......................... — 8 15 145 168

Other financing receivables ................... 2 1 2 240 245

Total finance receivables ......................... $ 4 $11 $80 $416 $511

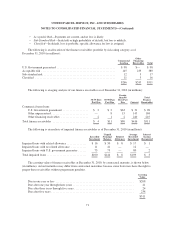

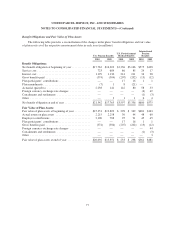

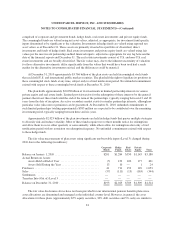

The following is an analysis of impaired finance receivables as of December 31, 2010 (in millions):

Recorded

Investment

Unpaid

Principal

Balance

Related

Allowance

Average

Recorded

Investment

Interest

Income

Recognized

Impaired loans with related allowance .............. $ 16 $ 30 $ 8 $ 17 $ 1

Impaired loans with no related allowance ........... 11 41 — 12 —

Impaired loans with U.S. government guarantee ...... 73 73 — 80 2

Total impaired loans ............................ $100 $144 $ 8 $109 $ 3

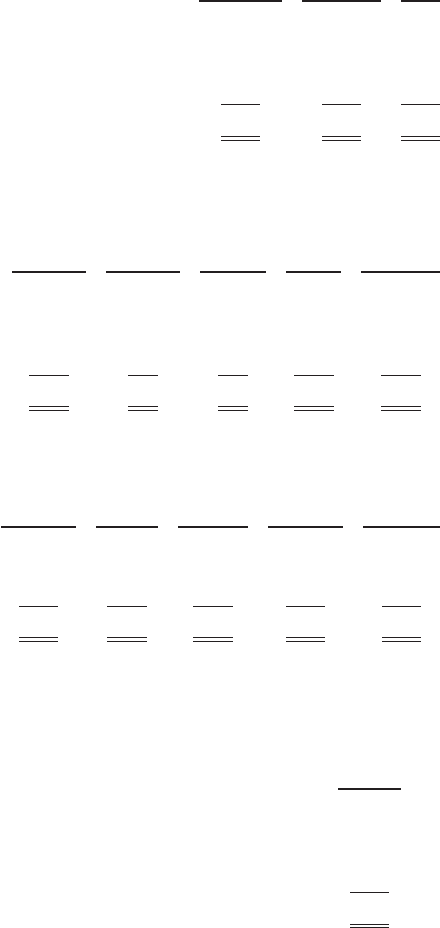

The carrying value of finance receivables at December 31, 2010, by contractual maturity, is shown below

(in millions). Actual maturities may differ from contractual maturities because some borrowers have the right to

prepay these receivables without prepayment penalties.

Carrying

Value

Due in one year or less ....................................................... $208

Due after one year through three years ........................................... 41

Due after three years through five years .......................................... 24

Due after five years .......................................................... 238

$511

71