UPS 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

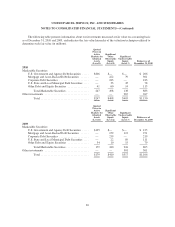

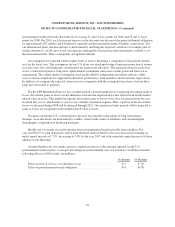

The decrease in U.S. pension benefits amounts where the projected benefit obligation exceeds the fair value

of plan assets is due to the funded status for both the UPS Retirement Plan and UPS Pension Plan changing from

liabilities at December 31, 2009 to assets at December 31, 2010.

The accumulated postretirement benefit obligation exceeds plan assets for all of our U.S. postretirement

medical benefit plans.

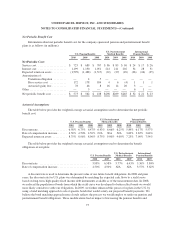

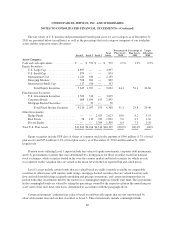

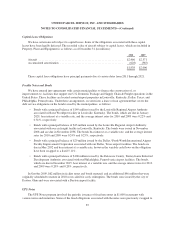

Accumulated Other Comprehensive Income

The amounts in AOCI expected to be amortized and recognized as a component of net periodic benefit cost

in 2011 are as follows (in millions):

U.S. Pension Benefits

U.S. Postretirement

Medical Benefits

International Pension

Benefits

Prior service cost / (benefit) .................... $170 $ 7 $1

Actuarial loss ............................... 283 21 4

$453 $28 $5

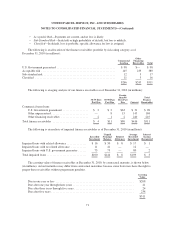

For all of our benefit plans, we utilize a corridor approach for determining the amount of unrecognized net

gain or loss that will be required to be amortized in the following year. The corridor is equal to 10% of the

greater of the projected benefit obligation or the market-related value of plan assets as of the beginning of the

year.

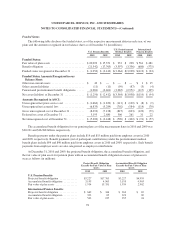

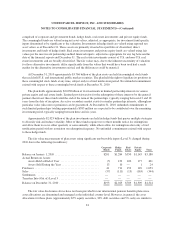

Pension and Postretirement Plan Assets

The applicable benefit plan committees establish investment guidelines and strategies, and regularly monitor

the performance of the funds and portfolio managers. Our investment guidelines address the following items:

governance, general investment beliefs and principles, investment objectives, specific investment goals, process

for determining/maintaining the asset allocation policy, long-term asset allocation, rebalancing, investment

restrictions/prohibited transactions, portfolio manager structure and diversification (which addresses limits on the

amount of investments held by any one manager to minimize risk), portfolio manager selection criteria, plan

evaluation, portfolio manager performance review and evaluation and risk management (including various

measures used to evaluate risk tolerance).

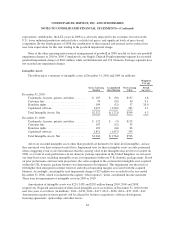

Our investment strategy with respect to pension assets is to invest the assets in accordance with applicable

laws and regulations. The long-term primary objectives for our pension assets are to: (1) provide for a reasonable

amount of long-term growth of capital, with prudent exposure to risk; and protect the assets from erosion of

purchasing power; (2) provide investment results that meet or exceed the plans’ expected long-term rate of

return; and (3) match the duration of the liabilities and assets of the plans to reduce the potential risk of large

employer contributions being necessary in the future. The plans strive to meet these objectives by employing

portfolio managers to actively manage assets within the guidelines and strategies set forth by the benefit plan

committees. These managers are evaluated by comparing their performance to applicable benchmarks.

79