UPS 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

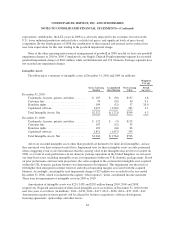

August 2009. This was offset by the decrease in the International Package and Supply Chain & Freight segments

due to the impact of the strengthening U.S. Dollar on the translation of non-U.S. Dollar goodwill balances.

The goodwill acquired in the International Package segment in 2009 was primarily due to the acquisition of

Unsped, as discussed further below. We also acquired an agent in Slovenia during the second quarter of 2009.

The increase in goodwill in the Supply Chain & Freight segment was due to the impact of fluctuations in the

U.S. Dollar with other currencies on the translation of non-U.S. Dollar goodwill balances, partially offset by the

allocation of goodwill to the sale of certain non-U.S. Mail Boxes Etc. franchise relationships.

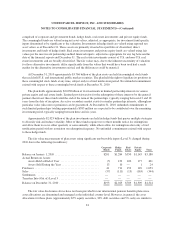

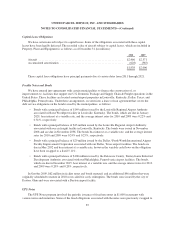

In August 2009, we completed the formation of a new joint venture headquartered in Dubai to develop and

grow UPS express package, freight forwarding and contract logistics services across the Middle East, Turkey and

portions of Central Asia. We own 80% of this joint venture, and we consolidate the financial statements of the

joint venture. In conjunction with the formation of this joint venture, the joint venture acquired the small package

operations of Unsped, our existing service agent in Turkey. We contributed certain existing UPS operations in

the region to the new joint venture, along with cash consideration of $40 million and an additional $40 million

that will be due on a deferred basis. We maintain an option to purchase the remaining 20% of the joint venture,

and the joint venture partner maintains a put option to require us to purchase the remaining 20% interest. Upon

exercise of the call or put option, a payment of $20 million will be required. An additional payment may be due

depending upon the earnings of the joint venture. The 20% portion of the joint venture that we do not own, which

represents temporary equity, is recorded as a noncontrolling interest in shareowners’ equity. The express package

business operations of Unsped are included in our International Package segment, while the freight forwarding

business of Unsped is included in our Supply Chain & Freight segment.

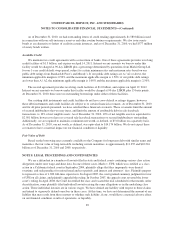

Pro forma results of operations have not been presented for these acquisitions, because the effects of these

transactions were not material. The results of operations of these acquired companies have been included in our

statements of consolidated income from the date of acquisition.

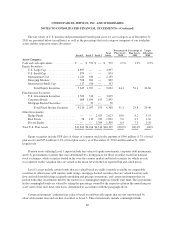

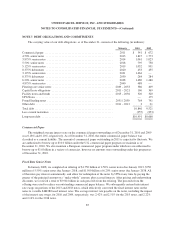

Goodwill Impairment

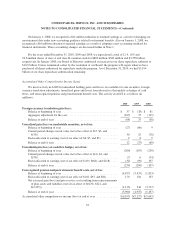

We test our goodwill for impairment annually, as of October 1st, on a reporting unit basis. Our reporting

units are comprised of the Europe, Asia, and Americas reporting units in the International Package reporting

segment, and the Forwarding & Logistics, UPS Freight, MBE / UPS Store, and UPS Capital reporting units in the

Supply Chain & Freight reporting segment. The impairment test involves a two-step process. First, a comparison

of the fair value of the applicable reporting unit with the aggregate carrying values, including goodwill, is

performed. We primarily determine the fair value of our reporting units using a discounted cash flow model, and

supplement this with observable valuation multiples for comparable companies, as applicable. If the carrying

amount of a reporting unit exceeds the reporting unit’s fair value, we perform the second step of the goodwill

impairment test to determine the amount of impairment loss. The second step includes comparing the implied fair

value of the affected reporting unit’s goodwill with the carrying value of that goodwill.

In the fourth quarter of 2008, we completed our annual goodwill impairment testing and determined that our

UPS Freight reporting unit, which was formed through the acquisition of Overnite Corporation in 2005, had a

goodwill impairment of $548 million which is included in the caption “other expenses” in the consolidated

income statement. This impairment charge resulted from several factors, including a lower cash flow forecast due

to a longer estimated economic recovery time for the LTL sector, and significant deterioration in equity

valuations for other similar LTL industry participants. At the time of acquisition of Overnite Corporation, LTL

equity valuations were higher and the economy was significantly stronger. We invested in operational

improvements and technology upgrades to enhance service and performance, as well as expand service offerings.

However, this process took longer than initially anticipated, and thus financial results have been below our

83