UPS 2010 Annual Report Download - page 53

Download and view the complete annual report

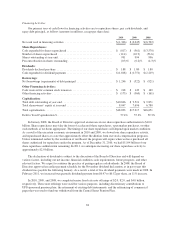

Please find page 53 of the 2010 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.uncertain tax positions because we are uncertain if or when such amounts will ultimately be settled in cash. In

addition, we also have recognized assets associated with uncertain tax positions in excess of the related liabilities

such that we do not believe a net contractual obligation exists to the taxing authorities. Uncertain tax positions

are further discussed in Note 12 to the consolidated financial statements.

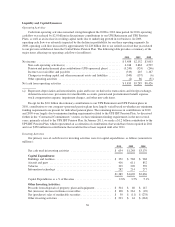

As of December 31, 2010, we had outstanding letters of credit totaling approximately $1.580 billion issued

in connection with routine business requirements. We also issue surety bonds as an alternative to letters of credit

in certain instances, and as of December 31, 2010, we had $577 million of surety bonds written. As of

December 31, 2010, we had unfunded loan commitments totaling $602 million associated with our financial

business.

We believe that funds from operations and borrowing programs will provide adequate sources of liquidity

and capital resources to meet our expected long-term needs for the operation of our business, including

anticipated capital expenditures, such as commitments for aircraft purchases, for the foreseeable future.

Contingencies

We are a defendant in a number of lawsuits filed in state and federal courts containing various class action

allegations under state wage-and-hour laws. In one of these cases, Marlo v. UPS, which was certified as a class

action in a California federal court in September 2004, plaintiffs allege that they improperly were denied

overtime, and seek penalties for missed meal and rest periods, and interest and attorneys’ fees. Plaintiffs purport

to represent a class of 1,300 full-time supervisors. In August 2005, the court granted summary judgment in favor

of UPS on all claims, and plaintiffs appealed the ruling. In October 2007, the appeals court reversed the lower

court’s ruling. In April 2008, the Court decertified the class and vacated the trial scheduled for that month. After

decertification, some plaintiffs filed individual lawsuits raising the same allegations as in the underlying class

action. These individual lawsuits are in various stages. We have denied any liability with respect to these claims

and intend to vigorously defend ourselves in these cases. At this time, we have not determined the amount of any

liability that may result from these matters or whether such liability, if any, would have a material adverse effect

on our financial condition, results of operations or liquidity.

UPS and our subsidiary Mail Boxes Etc., Inc. are defendants in various lawsuits brought by franchisees who

operate Mail Boxes Etc. centers and The UPS Store locations. These lawsuits relate to the rebranding of Mail

Boxes Etc. centers to The UPS Store, The UPS Store business model, the representations made in connection

with the rebranding and the sale of The UPS Store franchises, and UPS’s sale of services in the franchisees’

territories. In one of the actions, which is pending in California state court, the court certified a class consisting of

all Mail Boxes Etc. branded stores that rebranded to The UPS Store in March 2003. We have denied any liability

with respect to these claims and intend to defend ourselves vigorously. At this time, we have not determined the

amount of any liability that may result from these matters or whether such liability, if any, would have a material

adverse effect on our financial condition, results of operations or liquidity.

In Barber Auto Sales v. UPS, which a federal court in Alabama certified as a class action in September

2009, the plaintiff asserts a breach of contract claim arising from UPS’s assessment of shipping charge

corrections when UPS determines that the “dimensional weight” of packages is greater than reported by the

shipper. We have denied any liability with respect to these claims and intend to vigorously defend ourselves in

this case. At this time, we have not determined the amount of any liability that may result from this matter or

whether such liability, if any, would have a material adverse effect on our financial condition, results of

operations or liquidity.

In AFMS LLC v. UPS and FedEx Corporation, a lawsuit filed in federal court in the Central District of

California in August 2010, the plaintiff asserts that UPS and FedEx violated U.S. antitrust law by conspiring to

refuse to negotiate with third party negotiators retained by shippers and/or to monopolize a so-called market for

41