UPS 2010 Annual Report Download - page 62

Download and view the complete annual report

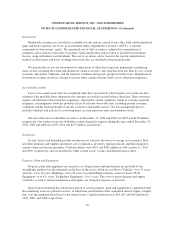

Please find page 62 of the 2010 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.require consideration of historical loss experience, adjusted for current conditions, trends in customer payment

frequency, and judgments about the probable effects of relevant observable data, including present economic

conditions and the financial health of specific customers and market sectors. Our risk management process

includes standards and policies for reviewing major account exposures and concentrations of risk. Deterioration

in macro economic variables could result in our ultimate loss exposures on our accounts receivable being

significantly higher than what we have currently estimated and reserved for in our allowance for doubtful

accounts. Our total allowance for doubtful accounts as of December 31, 2010 and 2009 was $127 and $138

million, respectively. Our total provision for doubtful accounts charged to expense during the years ended

December 31, 2010, 2009 and 2008 was $199, $254 and $277 million, respectively.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

We are exposed to market risk from changes in certain commodity prices, foreign currency exchange rates,

interest rates, and equity prices. All of these market risks arise in the normal course of business, as we do not

engage in speculative trading activities. In order to manage the risk arising from these exposures, we utilize a

variety of commodity, foreign exchange, and interest rate forward contracts, options, and swaps. A discussion of

our accounting policies for derivative instruments and further disclosures are provided in Note 14 to the

consolidated financial statements.

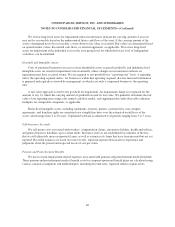

Commodity Price Risk

We are exposed to changes in the prices of refined fuels, principally jet-A, diesel, and unleaded gasoline.

Currently, the fuel surcharges that we apply to our domestic and international package and LTL services are the

primary means of reducing the risk of adverse fuel price changes. Additionally, we periodically use a

combination of option contracts to provide partial protection from changing fuel and energy prices. As of

December 31, 2010 and 2009, however, we had no commodity option contracts outstanding.

In the fourth quarter of 2008, we terminated several energy derivatives and received $87 million in cash.

This transaction was reported in other investing activities in the statements of consolidated cash flows. As these

derivatives qualified for hedge accounting, were designated as hedges, and maintained their effectiveness, the

gains associated with these hedges were recognized in income over the original term of the hedges, which

extended through the first quarter of 2009.

Foreign Currency Exchange Risk

We have foreign currency risks related to our revenue, operating expenses, and financing transactions in

currencies other than the local currencies in which we operate. We are exposed to currency risk from the

potential changes in functional currency values of our foreign currency-denominated assets, liabilities, and cash

flows. Our most significant foreign currency exposures relate to the Euro, the British Pound Sterling and the

Canadian Dollar. We use a combination of purchased and written options and forward contracts to hedge

forecasted cash flow currency exposures. These derivative instruments generally cover forecasted foreign

currency exposures for periods of 12 to 24 months. Additionally, we utilize cross-currency interest rate swaps to

hedge the currency risk inherent in the interest and principal payments associated with foreign currency

denominated debt obligations. The term of these swap agreements is commensurate with the underlying debt

obligations.

Interest Rate Risk

We have issued debt instruments, including debt associated with capital leases, that accrue expense at fixed

and floating rates of interest. We use a combination of interest rate swaps as part of our program to manage the

fixed and floating interest rate mix of our total debt portfolio and related overall cost of borrowing. The notional

amount, interest payment, and maturity dates of the swaps match the terms of the associated debt. We also utilize

50