UPS 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

impairment charge resulted from conversion offers from the issuers of these securities at prices well below the

stated redemption value of the preferred shares. These securities, which had a cost basis of $42 million, were

written down to their fair value of $25 million as of June 30, 2009, resulting in an other-than-temporary

impairment of $17 million.

Interest Expense

The decrease in interest expense in 2010 was primarily due to lower average debt balances, but this was

partially offset by lower capitalized interest, due to the recent completion of several large construction projects,

including our Worldport expansion. Excluding the currency remeasurement charge, the 2009 decrease in interest

expense was largely due to lower average debt balances and lower average interest rates incurred on variable rate

debt and interest rate swaps.

Income Tax Expense

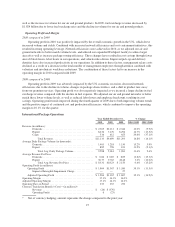

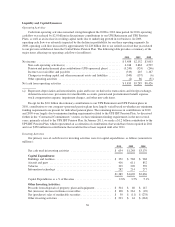

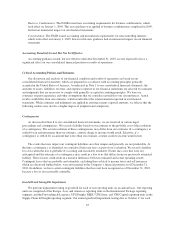

Year Ended December 31, % Change

2010 2009 2008 2010 / 2009 2009 / 2008

Income Tax Expense ........................ $2,035 $1,214 $2,012 67.6% (39.7)%

Impact of Charge for Change in Tax Filing

Status for German Subsidiary ........... (76) — —

Impact of Restructuring Charge ........... 34 — —

Impact of Gain on Sales of Businesses ...... (23) — —

Impact of Gain on Sale of Real Estate ....... (48) — —

Impact of Aircraft Impairment Charge ...... — 65 —

Impact of Currency Remeasurement

Charge ............................. — 29 —

Adjusted Income Tax Expense ........ $1,922 $1,308 $2,012 46.9% (35.0)%

Effective Tax Rate .......................... 36.8% 36.1% 40.1%

Adjusted Effective Tax Rate .................. 35.0% 36.1% 36.0%

2010 compared to 2009

The increase in our effective tax rate in 2010 compared with 2009 was attributable to the higher marginal

tax rate applied to the gain on the sale of real estate, as well as the change in the tax filing status of a German

subsidiary that occurred in the first quarter of 2010. Additionally, we are currently unable to recognize the entire

potential tax benefit of tax loss carryforwards generated from the sale of a Supply Chain & Freight business in

Germany in the first quarter of 2010.

Excluding these items, our adjusted year-to-date effective tax rate decreased in 2010 compared to 2009

primarily due to the effect of having a higher proportion of our taxable income in 2010 being subject to tax

outside the United States, where statutory tax rates are generally lower.

2009 compared to 2008

Income tax expense declined primarily due to lower pre-tax income. The decrease in our effective tax rate

was primarily due to the goodwill and intangible impairment charges described previously, which were not

deductible for tax purposes and resulted in the effective tax rate increasing by 4.1%. This was partially offset by

an increase in our first quarter 2009 income tax provision as a result of providing a valuation allowance of $14

million against certain deferred tax assets in our International Package business.

35