UPS 2010 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2010 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

We received cash of $60, $27, and $46 million during 2010, 2009, and 2008, respectively, from option

holders resulting from the exercise of stock options. We received a tax benefit of $4, $1, and $4 million during

2010, 2009, and 2008, respectively, from the exercise of stock options, which is reported as cash from financing

activities in the cash flow statement.

The total intrinsic value of options exercised during 2010, 2009, and 2008 was $18, $5, and $13 million,

respectively. As of December 31, 2010, there was $11 million of total unrecognized compensation cost related to

nonvested options. That cost is expected to be recognized over a weighted average period of 1 year and 6 months.

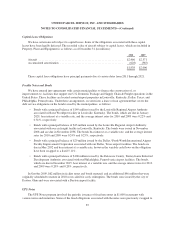

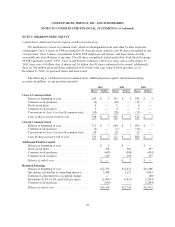

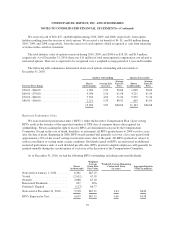

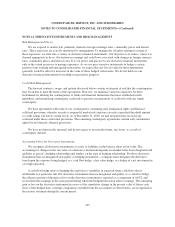

The following table summarizes information about stock options outstanding and exercisable at

December 31, 2010:

Options Outstanding Options Exercisable

Exercise Price Range

Shares

(in thousands)

Average Life

(in years)

Average

Exercise

Price

Shares

(in thousands)

Average

Exercise

Price

$50.01 - $60.00 ........................... 1,302 1.81 56.68 1,098 56.83

$60.01 - $70.00 ........................... 4,396 2.16 61.58 4,211 61.34

$70.01 - $80.00 ........................... 7,393 4.82 71.22 5,279 71.34

$80.01 - $90.00 ........................... 2,211 5.33 80.92 605 81.01

15,302 3.87 $68.62 11,193 $66.68

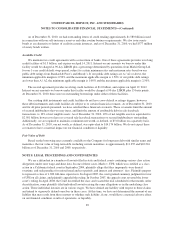

Restricted Performance Units

We issue restricted performance units (“RPUs”) under the Incentive Compensation Plan. Upon vesting,

RPUs result in the issuance of the equivalent number of UPS class A common shares after required tax

withholdings. Persons earning the right to receive RPUs are determined each year by the Compensation

Committee. Except in the case of death, disability, or retirement, all RPUs granted prior to 2008 vest five years

after the date of grant. Beginning in 2008, RPU awards granted will generally vest over a five year period with

approximately 20% of the award vesting at each anniversary date of the grant. All RPUs granted are subject to

earlier cancellation or vesting under certain conditions. Dividends earned on RPUs are reinvested in additional

restricted performance units at each dividend payable date. RPUs granted to eligible employees will generally be

granted annually during the second quarter of each year at the discretion of the Compensation Committee.

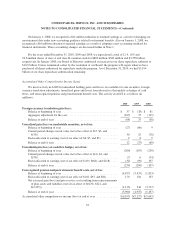

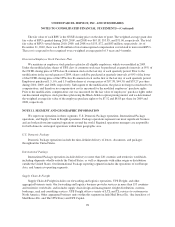

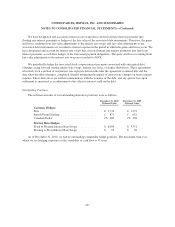

As of December 31, 2010, we had the following RPUs outstanding, including reinvested dividends:

Shares

(in thousands)

Weighted

Average

Grant Date

Fair Value

Weighted Average Remaining

Contractual Term

(in years)

Aggregate Intrinsic

Value (in millions)

Nonvested at January 1, 2010 ....... 6,361 $67.25

Vested ......................... (2,611) 67.99

Granted ........................ 2,088 67.18

Reinvested Dividends ............. 207 N/A

Forfeited / Expired ............... (127) 66.77

Nonvested at December 31, 2010 .... 5,918 $67.11 1.64 $430

RPUs Expected to Vest ............ 6,029 $67.15 1.66 $438

97