UPS 2010 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2010 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

our U.S. plans. The amount of assets having significant unobservable inputs (Level 3), if any, in these plans

would be immaterial to our financial statements.

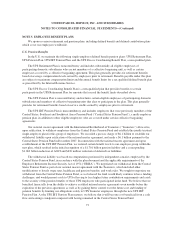

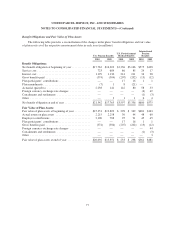

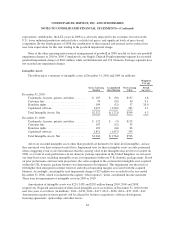

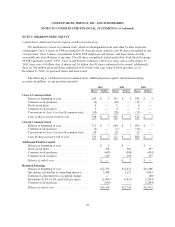

Expected Cash Flows

Information about expected cash flows for the pension and postretirement benefit plans is as follows (in

millions):

U.S.

Pension Benefits

U.S. Postretirement

Medical Benefits

International Pension

Benefits

Employer Contributions:

2011 (expected) to plan trusts ..................... $1,200 $ — $ 41

2011 (expected) to plan participants ................ 12 102 2

Expected Benefit Payments:

2011 ..................................... $ 611 $ 213 $ 14

2012 ..................................... 690 226 16

2013 ..................................... 772 246 17

2014 ..................................... 862 228 18

2015 ..................................... 958 244 21

2016 - 2020 ............................... 6,483 1,436 142

Our funding policy for U.S. plans is to contribute amounts annually that are at least equal to the amounts

required by applicable laws and regulations, or to directly fund payments to plan participants, as applicable.

International plans will be funded in accordance with local regulations. The 2011 (expected) to plan trusts

contribution of $1.2 billion for U.S. pension benefits was made in January 2011. Additional discretionary

contributions may be made when deemed appropriate to meet the long-term obligations of the plans. Expected

benefit payments for pensions will be primarily paid from plan trusts. Expected benefit payments for

postretirement medical benefits will be paid from plan trusts and corporate assets.

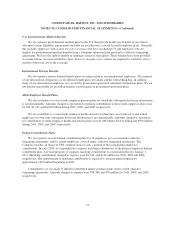

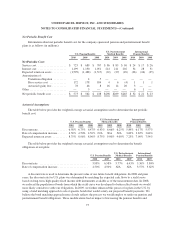

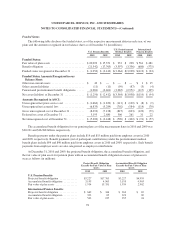

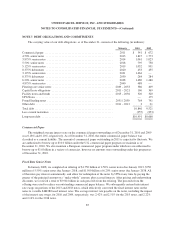

NOTE 6. BUSINESS ACQUISITIONS, GOODWILL AND INTANGIBLE ASSETS

The following table indicates the allocation of goodwill by reportable segment (in millions):

U.S. Domestic

Package

International

Package

Supply Chain &

Freight Consolidated

December 31, 2008 balance ...................... $— $288 $1,698 $1,986

Acquired ................................. — 82 — 82

Disposals ................................ — — (6) (6)

Currency / Other .......................... — 4 23 27

December 31, 2009 balance ...................... $— $374 $1,715 $2,089

Acquired ................................. — — — —

Purchase Accounting Adjustments ............ — 5 (2) 3

Currency / Other .......................... — (2) (9) (11)

December 31, 2010 balance ...................... $— $377 $1,704 $2,081

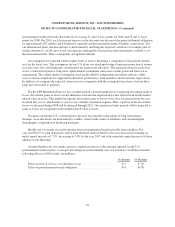

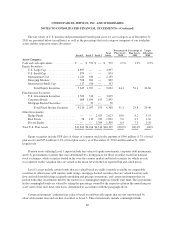

Business Acquisitions

The increase to goodwill in the International Package segment during 2010 was due to adjustments to the

purchase price allocation for Unsped Paket Servisi San ve Ticaret A.S. (“Unsped”), which was acquired in

82