UPS 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

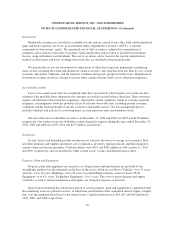

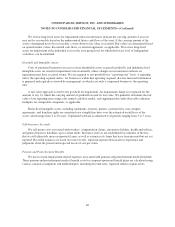

Historically, the par value of the auction rate securities approximated fair value due to the frequent resetting

of the interest rate. While we will continue to earn interest on these investments in failed auction rate securities

(often at the maximum contractual interest rate), the estimated fair value of the auction rate securities no longer

approximates par value due to the lack of liquidity. We estimated the fair value of these securities after

considering several factors, including the credit quality of the securities, the rate of interest received since the

failed auctions began, the yields of securities similar to the underlying auction rate securities, and the input of

broker-dealers in these securities. As a result, we recorded an after-tax unrealized loss of approximately $4

million on these securities as of December 31, 2010 in other comprehensive income ($6 million pre-tax),

reflecting the decline in the estimated fair value of these securities.

Investment Other-Than-Temporary Impairments

During the second quarter of 2010, we recorded impairment losses on certain asset-backed auction rate

securities. The impairment charge resulted from provisions that allow the issuers of the securities to subordinate

our holdings to newly issued debt or to tender for the securities at less than their par value. These securities,

which had a cost basis of $128 million, were written down to their fair value of $107 million as of June 30, 2010,

as an other-than-temporary impairment. The $21 million total impairment charge during the second quarter was

recorded as a loss in investment income (loss) on the statement of consolidated income.

During the second quarter of 2009, we recorded impairment losses on certain perpetual preferred securities,

and an auction rate security collateralized by preferred securities, issued by large financial institutions. The

impairment charge results from conversion offers from the issuers of these securities at prices well below the

stated redemption value of the preferred shares. These securities, which had a cost basis of $42 million, were

written down to their fair value of $25 million as of June 30, 2009, as an other-than-temporary impairment. The

$17 million total impairment charge during the second quarter was recorded as a loss in investment income (loss)

on the statement of consolidated income.

During the third quarter of 2008, we recorded impairment losses on two auction rate securities that were

collateralized by preferred stock issued by the Federal National Mortgage Association (“FNMA”) and the

Federal Home Loan Mortgage Corporation (“FHLMC”). The impairment resulted from actions by the U.S.

Department of the Treasury and the Federal Housing Finance Agency to place FNMA and FHLMC under

conservatorship. Additionally, we recorded impairment losses on a municipal auction rate security and on

holdings of several medium term notes issued by Lehman Brothers Inc., which declared bankruptcy during the

third quarter of 2008. We do not hold any other securities in any of these entities. The total of these credit-related

impairment losses during the year was $23 million, which was recorded as a loss in investment income (loss) on

the statement of consolidated income.

For the remaining auction rate securities and other debt securities, we have concluded that no additional

other-than-temporary impairment losses existed as of December 31, 2010. In making this determination, we

considered the financial condition and prospects of the issuer, the magnitude of the losses compared with the

investments’ cost, the probability that we will be unable to collect all amounts due according to the contractual

terms of the security, the credit rating of the security, and our ability and intent to hold these investments until the

anticipated recovery in market value occurs.

66