UPS 2010 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2010 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

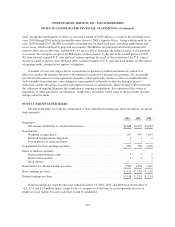

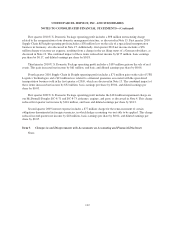

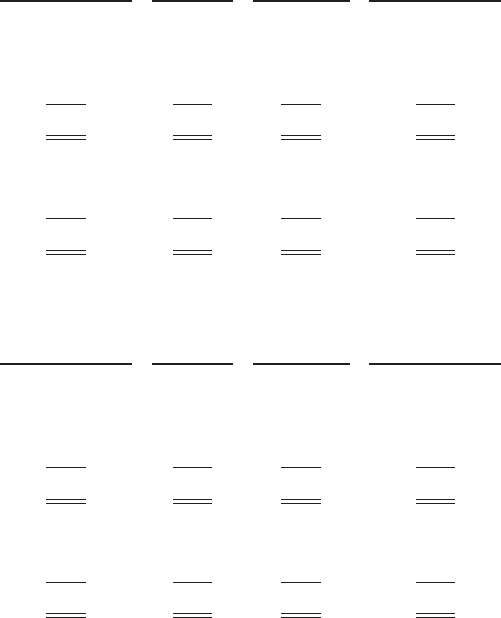

Fair Value Measurements

Our foreign currency, interest rate, and energy derivatives are largely comprised of over-the-counter

derivatives, which are primarily valued using pricing models that rely on market observable inputs such as yield

curves, currency exchange rates, and commodity forward prices, and therefore are classified as Level 2. The fair

values of our derivative assets and liabilities as of December 31, 2010 and 2009 by hedge type are as follows (in

millions):

Quoted Prices in

Active Markets for

Identical Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Balance as of

December 31, 2010

2010:

Assets

Foreign Exchange Contracts ............... $— $ 36 $— $ 36

Interest Rate Contracts .................... — 182 — 182

Total .............................. $— $218 $— $218

Liabilities

Foreign Exchange Contracts ............... $— $111 $— $111

Interest Rate Contracts .................... — 30 — 30

Total .............................. $— $141 $— $141

Quoted Prices in

Active Markets for

Identical Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Balance as of

December 31, 2009

2009:

Assets

Foreign Exchange Contracts ............... $— $ 63 $— $ 63

Interest Rate Contracts .................... — 74 — 74

Total .............................. $— $137 $— $137

Liabilities

Foreign Exchange Contracts ............... $— $ 51 $— $ 51

Interest Rate Contracts .................... — 15 — 15

Total .............................. $— $ 66 $— $ 66

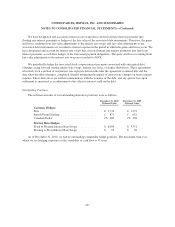

NOTE 15. RESTRUCTURING COSTS AND BUSINESS DISPOSITIONS

We have incurred restructuring costs associated with the termination of employees, facility consolidations

and other costs directly related to restructuring initiatives. These initiatives have resulted from the integration of

acquired companies, as well as restructuring activities associated with cost containment and operational

efficiency programs. Additionally, we have sold or shut-down certain non-core business units in 2010, and

recorded gains or losses upon the sale, as well as costs associated with each transaction.

Supply Chain & Freight—Germany

In February 2010, we completed the sale of a specialized transportation and express freight business in

Germany within our Supply Chain & Freight segment. As part of the sale transaction, we incurred certain costs

110