UPS 2010 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2010 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

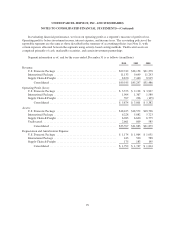

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

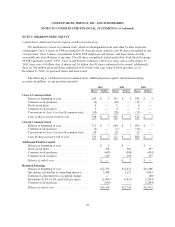

NOTE 9. SHAREOWNERS’ EQUITY

Capital Stock, Additional Paid-In Capital, and Retained Earnings

We maintain two classes of common stock, which are distinguished from each other by their respective

voting rights. Class A shares of UPS are entitled to 10 votes per share, whereas class B shares are entitled to one

vote per share. Class A shares are primarily held by UPS employees and retirees, and these shares are fully

convertible into class B shares at any time. Class B shares are publicly traded on the New York Stock Exchange

(NYSE) under the symbol “UPS.” Class A and B shares both have a $0.01 par value, and as of December 31,

2010, there were 4.6 billion class A shares and 5.6 billion class B shares authorized to be issued. Additionally,

there are 200 million preferred shares authorized to be issued, with a par value of $0.01 per share; as of

December 31, 2010, no preferred shares had been issued.

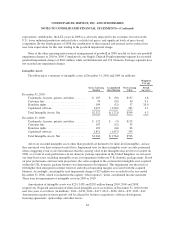

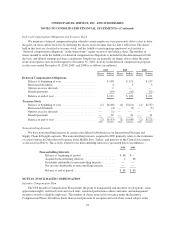

The following is a rollforward of our common stock, additional paid-in capital, and retained earnings

accounts (in millions, except per share amounts):

2010 2009 2008

Shares Dollars Shares Dollars Shares Dollars

Class A Common Stock

Balance at beginning of year .................. 285 $ 3 314 $ 3 349 $ 3

Common stock purchases ..................... (6) — (10) — (11) —

Stock award plans ........................... 6 — 5 — 6 —

Common stock issuances ..................... 3 — 4 — 3 —

Conversions of class A to class B common stock . . (30) — (28) — (33) —

Class A shares issued at end of year ............. 258 $ 3 285 $ 3 314 $ 3

Class B Common Stock

Balance at beginning of year .................. 711 $ 7 684 $ 7 694 $ 7

Common stock purchases ..................... (6) — (1) — (43) —

Conversions of class A to class B common stock . . 30 — 28 — 33 —

Class B shares issued at end of year ............. 735 $ 7 711 $ 7 684 $ 7

Additional Paid-In Capital

Balance at beginning of year .................. $ 2 $ — $ —

Stock award plans ........................... 398 381 497

Common stock purchases ..................... (649) (569) (694)

Common stock issuances ..................... 249 190 197

Balance at end of year ....................... $ — $ 2 $ —

Retained Earnings

Balance at beginning of year .................. $12,745 $12,412 $14,186

Net income attributable to controlling interests .... 3,488 2,152 3,003

Cumulative adjustment for accounting changes .... — — (60)

Dividends ($1.88, $1.80, and $1.68 per share) ..... (1,909) (1,819) (1,853)

Common stock purchases ..................... (160) — (2,864)

Balance at end of year ....................... $14,164 $12,745 $12,412

92