UPS 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

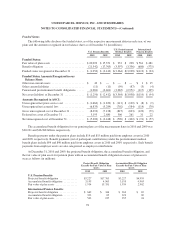

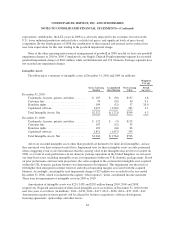

U.S. Postretirement Medical Benefits

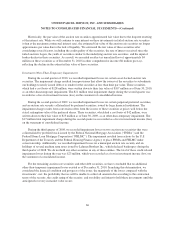

We also sponsor postretirement medical plans in the U.S. that provide health care benefits to our retirees

who meet certain eligibility requirements and who are not otherwise covered by multi-employer plans. Generally,

this includes employees with at least 10 years of service who have reached age 55 and employees who are

eligible for postretirement medical benefits from a Company-sponsored plan pursuant to collective bargaining

agreements. We have the right to modify or terminate certain of these plans. These benefits have been provided

to certain retirees on a noncontributory basis; however, in many cases, retirees are required to contribute all or a

portion of the total cost of the coverage.

International Pension Benefits

We also sponsor various defined benefit plans covering certain of our international employees. The majority

of our international obligations are for defined benefit plans in Canada and the United Kingdom. In addition,

many of our international employees are covered by government-sponsored retirement and pension plans. We are

not directly responsible for providing benefits to participants of government-sponsored plans.

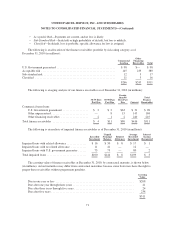

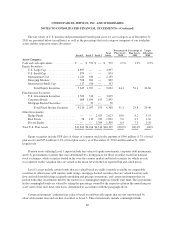

Multi-Employer Benefit Plans

We also contribute to several multi-employer pension plans for which the subsequent disclosure information

is not determinable. Amounts charged to operations for pension contributions to these multi-employer plans were

$1.186, $1.125 and $1.069 billion during 2010, 2009, and 2008, respectively.

We also contribute to several multi-employer health and welfare plans that cover both active and retired

employees for which the subsequent disclosure information is not determinable. Amounts charged to operations

for contributions to multi-employer health and welfare plans were $1.066 billion, $1.031 billion and $990 million

during 2010, 2009, and 2008, respectively.

Defined Contribution Plans

We also sponsor several defined contribution plans for all employees not covered under collective

bargaining agreements, and for certain employees covered under collective bargaining agreements. The

Company matches, in shares of UPS common stock or cash, a portion of the participating employees’

contributions. In early 2009, we suspended the company matching contributions to the primary employee defined

contribution plan. A revised program of company matching contributions was reinstated effective January 1,

2011. Matching contributions charged to expense were $4, $21, and $116 million for 2010, 2009 and 2008,

respectively. The reinstatement of matching contributions is expected to increase annual expense by

approximately $75 million beginning in 2011.

Contributions are also made to defined contribution money purchase plans under certain collective

bargaining agreements. Amounts charged to expense were $78, $80 and $78 million for 2010, 2009, and 2008,

respectively.

74