UPS 2010 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2010 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

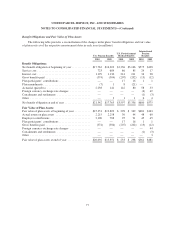

comprised of corporate and government bonds, hedge funds, real estate investments and private equity funds.

The commingled funds are valued using net asset values, adjusted, as appropriate, for investment fund specific

inputs determined to be significant to the valuation. Investments in hedge funds are valued using reported net

asset values as of December 31. These assets are primarily invested in a portfolio of diversified, direct

investments and funds of hedge funds. Real estate investments and private equity funds are valued using fair

values per the most recent partnership audited financial reports, adjusted as appropriate for any lag between the

date of the financial reports and December 31. The real estate investments consist of U.S. and non-U.S. real

estate investments and are broadly diversified. The fair values may, due to the inherent uncertainty of valuation

for those alternative investments, differ significantly from the values that would have been used had a ready

market for the alternative investments existed, and the differences could be material.

At December 31, 2010 approximately $3.766 billion of the plan assets are held in comingled stock funds

that each hold U.S. and international public market securities. The plan held the right to liquidate its positions in

these commingled stock funds at any time, subject only to a brief notification period. No unfunded commitment

existed with respect to these commingled stock funds at December 31, 2010.

The plan holds approximately $2.098 billion of its investments in limited partnership interests in various

private equity and real estate funds. Limited provision exists for the redemption of these interests by the general

partners that invest these funds until the end of the term of the partnerships, typically ranging between 12 and 18

years from the date of inception. An active secondary market exists for similar partnership interests, although no

particular value (discount or premium) can be guaranteed. At December 31, 2010, unfunded commitments to

such limited partnerships totaling approximately $585 million are expected to be contributed over the remaining

investment period, typically ranging between three and six years.

Approximately $2.023 billion of the plan investments are held in hedge funds that pursue multiple strategies

to diversify risk and reduce volatility. Most of these funds require two to three months notice for redemptions

and allow them to occur either quarterly or semi-annually, while others allow for redemption after only a brief

notification period with no restriction on redemption frequency. No unfunded commitments existed with respect

to these hedge funds.

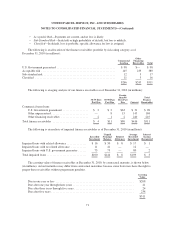

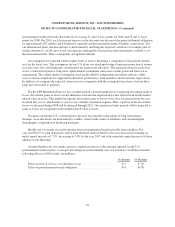

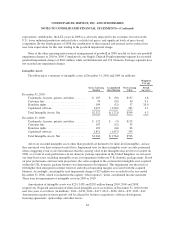

The fair value measurement of plan assets using significant unobservable inputs (Level 3) changed during

2010 due to the following (in millions):

Corporate

Bonds

Hedge

Funds

Real

Estate

Private

Equity Total

Balance on January 1, 2010 ............................... $201 $1,284 $550 $1,145 $3,180

Actual Return on Assets:

Assets Held at End of Year ........................... (5) 129 100 177 401

Assets Sold During the Year .......................... 13 10 — 1 24

Purchases ............................................. 41 711 152 149 1,053

Sales ................................................. (57) (111) (13) (163) (344)

Settlements ........................................... — — — — —

Transfers Into (Out of) Level 3 ............................ — — — — —

Balance on December 31, 2010 ............................ $193 $2,023 $789 $1,309 $4,314

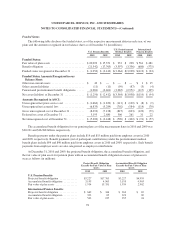

The fair value disclosures above have not been provided for our international pension benefits plans since

asset allocations are determined and managed at the individual country level. However, in general, the asset

allocations for these plans (approximately 65% equity securities, 30% debt securities and 5% cash) are similar to

81