UPS 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

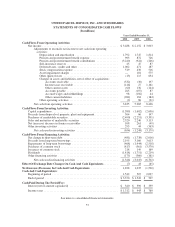

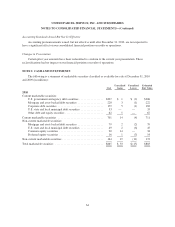

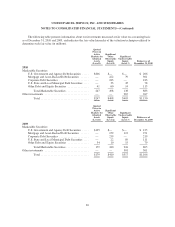

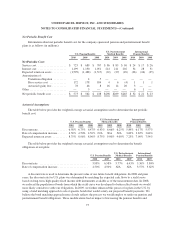

Unrealized Losses

The following table presents the age of gross unrealized losses and fair value by investment category for all

securities in a loss position as of December 31, 2010 (in millions):

Less Than 12 Months 12 Months or More Total

Fair

Value

Unrealized

Losses

Fair

Value

Unrealized

Losses

Fair

Value

Unrealized

Losses

U.S. government and agency debt securities ....... $ 75 $ (2) $— $— $ 75 $ (2)

Mortgage and asset-backed debt securities ........ 93 (1) 28 (2) 121 (3)

Corporate debt securities ...................... 65 (1) — — 65 (1)

U.S. state and local municipal debt securities ...... — — 21 (6) 21 (6)

Other debt securities .......................... 3 — — — 3 —

Total debt securities ...................... 236 (4) 49 (8) 285 (12)

Common equity securities ..................... — — ————

Preferred equity securities ..................... — — 6 (3) 6 (3)

$236 $ (4) $ 55 $ (11) $291 $ (15)

The unrealized losses in the U.S. state and local municipal securities, preferred equity securities, and

mortgage and asset-backed securities primarily relate to the auction rate securities discussed previously. The

unrealized losses for the non-auction rate securities within those categories are primarily related to various fixed

income securities, and are primarily due to changes in market interest rates. We have both the intent and ability

to hold the securities contained in the previous table for a time necessary to recover the cost basis.

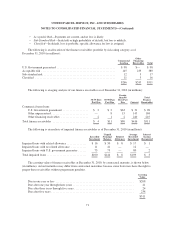

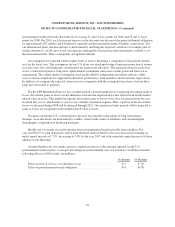

Maturity Information

The amortized cost and estimated fair value of marketable securities at December 31, 2010, by contractual

maturity, are shown below (in millions). Actual maturities may differ from contractual maturities because the

issuers of the securities may have the right to prepay obligations without prepayment penalties.

Cost

Estimated

Fair Value

Due in one year or less ............................................... $102 $102

Due after one year through three years .................................. 213 215

Due after three years through five years ................................. 52 52

Due after five years ................................................. 443 441

810 810

Equity securities .................................................... 55 73

$865 $883

Restricted Cash

Restricted cash and cash equivalents relate to our self-insurance requirements. In 2008, we entered into an

escrow agreement with an insurance carrier to guarantee our self-insurance obligations. This agreement requires

us to provide cash collateral to the insurance carrier, which is classified as other non-current assets on our

consolidated balance sheets. Additional cash collateral provided is reflected in other investing activities in the

statements of consolidated cash flows. This restricted cash is invested in money market funds and similar cash

equivalent type assets. As of December 31, 2010 and 2009, we had $286 million in restricted cash.

67