U-Haul 2016 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

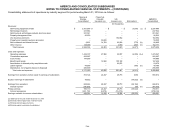

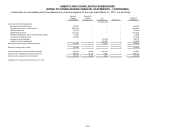

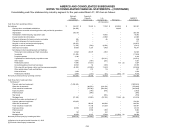

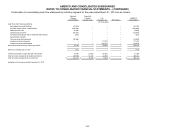

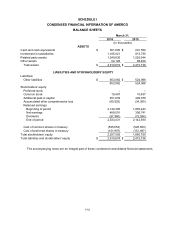

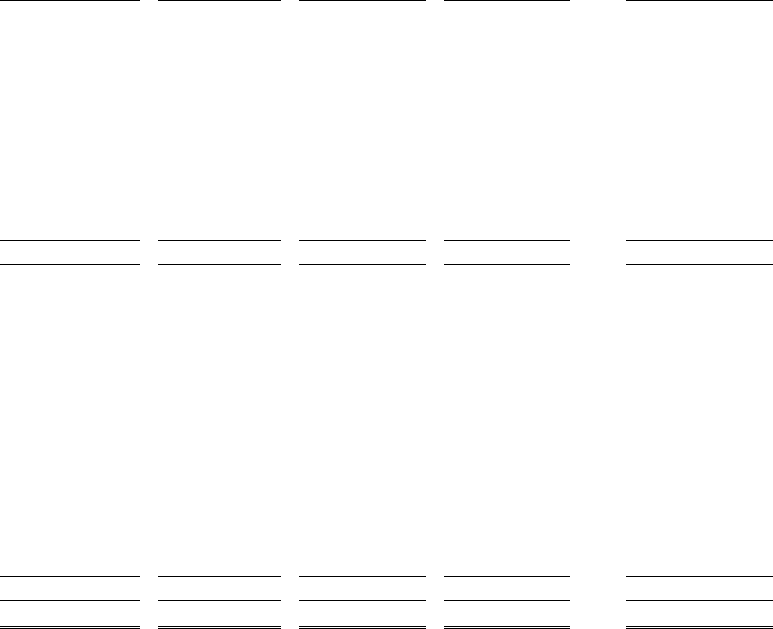

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (CONTINUED)

F-43

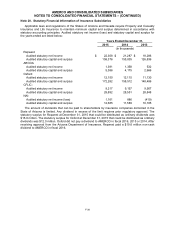

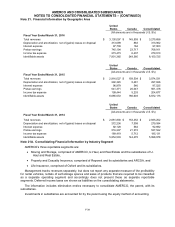

Consolidating balance sheets by industry segment as of March 31, 2015 are as follows:

Moving &

Storage

Consolidated

Property &

Casualty

Insurance (a)

Life

Insurance (a)

Eliminations

AMERCO

Consolidated

(In thousands)

Liabilities:

Accounts payable and accrued expenses

$

489,140

$

1,235

$

5,995

$

–

$

496,370

Notes, loans and leases payable

2,190,869

–

–

–

2,190,869

Policy benefits and losses, claims and loss expenses payable

363,552

271,744

426,892

–

1,062,188

Liabilities from investment contracts

–

–

685,745

–

685,745

Other policyholders' funds and liabilities

–

2,837

4,927

–

7,764

Deferred income

18,081

–

–

–

18,081

Deferred income taxes

524,550

(18,592)

20,841

–

526,799

Related party liabilities

13,919

2,073

112

(16,104)

(c)

–

Total liabilities

3,600,111

259,297

1,144,512

(16,104)

4,987,816

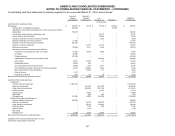

Stockholders' equity :

Series preferred stock:

Series A preferred stock

–

–

–

–

–

Series B preferred stock

–

–

–

–

–

Series A common stock

–

–

–

–

–

Common stock

10,497

3,301

2,500

(5,801)

(b)

10,497

Additional paid-in capital

449,878

91,120

26,271

(117,601)

(b)

449,668

Accumulated other comprehensive income (loss)

(34,365)

8,871

32,310

(41,181)

(b)

(34,365)

Retained earnings (deficit)

2,142,390

66,001

213,088

(278,879)

(b)

2,142,600

Cost of common shares in treasury, net

(525,653)

–

–

–

(525,653)

Cost of preferred shares in treasury, net

(151,997)

–

–

–

(151,997)

Unearned employee stock ownership plan shares

(6,391)

–

–

–

(6,391)

Total stockholders' equity (deficit)

$

1,884,359

169,293

274,169

(443,462)

1,884,359

Total liabilities and stockholders' equity

5,484,470

$

428,590

$

1,418,681

$

(459,566)

$

6,872,175

(a) Balances as of December 31, 2014

(b) Eliminate investment in subsidiaries

(c) Eliminate intercompany receivables and payables