U-Haul 2016 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

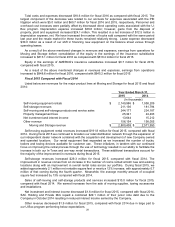

Total costs and expenses decreased $18.6 million for fiscal 2016 as compared with fiscal 2015. The

largest component of the decrease was related to our accruals for expenses associated with the PEI

litigation which were $5.0 million and $60.7 million for fiscal 2016 and 2015, respectively. Personnel and

overhead cost increases were partially offset by decreased direct operating costs associated with the U-

Box program. Depreciation expense increased $36.6 million; however, gains from the disposal of

property, plant and equipment increased $24.1 million. This resulted in a net increase of $12.5 million in

depreciation expense, net. We have increased the number of trucks sold compared with the same period

last year and the resale market for these trucks remained relatively strong. Lease expense decreased

$30.0 million as a result of our shift in financing new equipment on the balance sheet versus through

operating leases.

As a result of the above mentioned changes in revenues and expenses, earnings from operations for

Moving and Storage before consolidation of the equity in the earnings of the insurance subsidiaries

increased to $813.1 million for fiscal 2016 as compared with $610.4 million for fiscal 2015.

Equity in the earnings of AMERCO’s insurance subsidiaries increased $0.7 million for fiscal 2016,

compared with fiscal 2015.

As a result of the above mentioned changes in revenues and expenses, earnings from operations

increased to $848.6 million for fiscal 2016, compared with $645.2 million for fiscal 2015.

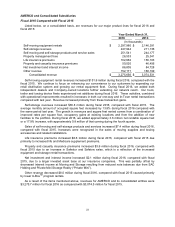

Fiscal 2015 Compared with Fiscal 2014

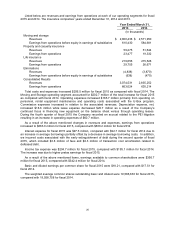

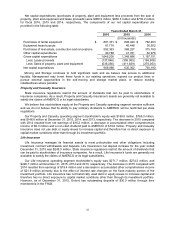

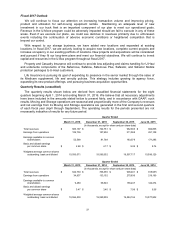

Listed below are revenues for the major product lines at Moving and Storage for fiscal 2015 and fiscal

2014:

Year Ended March 31,

2015

2014

(In thousands)

Self-moving equipment rentals

$

2,149,986

$

1,958,209

Self-storage revenues

211,136

181,794

Self-moving and self-storage products and service sales

244,177

234,187

Property management fees

25,341

24,493

Net investment and interest income

13,644

15,212

Other revenue

156,154

158,055

Moving and Storage revenue

$

2,800,438

$

2,571,950

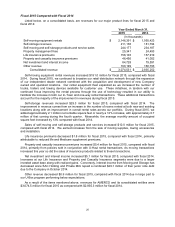

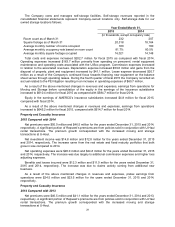

Self-moving equipment rental revenues increased $191.8 million for fiscal 2015, compared with fiscal

2014. During fiscal 2015 we continued to broaden our retail distribution network through the expansion of

our independent dealer network combined with the acquisition and development of new Company owned

and operated locations. Our rental equipment fleet expanded as we increased the number of trucks,

trailers and towing devices available for customer use. These initiatives, in tandem with our continued

focus on improving the rental process through the use of technology resulted in our ability to facilitate the

increase in both our In-Town and one-way rental transactions. These additional transactions account for

the majority of the improvement in revenues during fiscal 2015.

Self-storage revenues increased $29.3 million for fiscal 2015, compared with fiscal 2014. The

improvement in revenue comes from an increase in the number of rooms rented at both new and existing

locations along with an improvement in overall rental rates across our portfolio. During fiscal 2015, we

added approximately 2.1 million net rentable square feet or nearly a 12% increase, with approximately 0.7

million of that coming during the fourth quarter. Meanwhile, the average monthly amount of occupied

square feet increased by 13% compared with fiscal 2014.

Sales of self-moving and self-storage products and services increased $10.0 million for fiscal 2015,

compared with fiscal 2014. We earned increases from the sale of moving supplies, towing accessories

and installations.

Net investment and interest income decreased $1.6 million for fiscal 2015, compared with fiscal 2014.

SAC Holding and Private Mini repaid a combined $29.1 million of their junior note debt due to the

Company in October 2014 resulting in reduced interest income earned by the Company.

Other revenue decreased $1.9 million for fiscal 2015, compared with fiscal 2014 due in large part to

our U-Box program performing below expectations.