U-Haul 2016 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

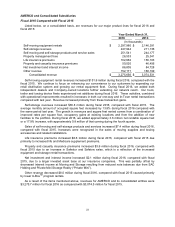

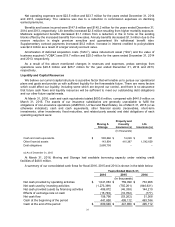

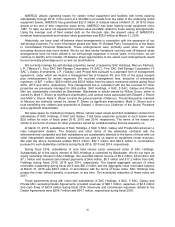

Listed below are revenues and earnings from operations at each of our operating segments for fiscal

2015 and 2014. The insurance companies’ years ended December 31, 2014 and 2013.

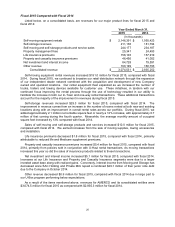

Year Ended March 31,

2015

2014

(In thousands)

Moving and storage

Revenues

$

2,800,438

$

2,571,950

Earnings from operations before equity in earnings of subsidiaries

610,430

584,681

Property and casualty insurance

Revenues

59,275

51,644

Earnings from operations

23,477

19,332

Life insurance

Revenues

219,656

215,528

Earnings from operations

29,755

26,671

Eliminations

Revenues

(4,838)

(3,870)

Earnings from operations before equity in earnings of subsidiaries

(638)

(470)

Consolidated Results

Revenues

3,074,531

2,835,252

Earnings from operations

663,024

630,214

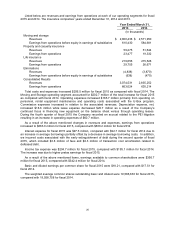

Total costs and expenses increased $206.5 million for fiscal 2015 as compared with fiscal 2014. The

Moving and Storage operating segment accounted for $202.7 million of the total increase for fiscal 2015

as compared with fiscal 2014. Operating expenses increased $165.7 million primarily from spending on

personnel, rental equipment maintenance and operating costs associated with the U-Box program.

Commission expenses increased in relation to the associated revenues. Depreciation expense, net,

increased $18.6 million while lease expense decreased $20.7 million as a result of the Company’s

continued focus in financing new equipment on the balance sheet versus through operating leases.

During the fourth quarter of fiscal 2015 the Company recorded an accrual related to the PEI litigation

resulting in an increase in operating expenses of $60.7 million.

As a result of the above mentioned changes in revenues and expenses, earnings from operations

increased to $663.0 million for fiscal 2015, compared with $630.2 million for fiscal 2014.

Interest expense for fiscal 2015 was $97.5 million, compared with $92.7 million for fiscal 2014 due to

an increase in average borrowings partially offset by a decrease in average borrowing costs. In addition,

we incurred costs associated with the early extinguishment of debt during the second quarter of fiscal

2015, which included $3.8 million of fees and $0.3 million of transaction cost amortization related to

defeased debt.

Income tax expense was $204.7 million for fiscal 2015, compared with $195.1 million for fiscal 2014.

The increase was due to higher pretax earnings for fiscal 2015.

As a result of the above mentioned items, earnings available to common shareholders were $356.7

million for fiscal 2015, compared with $342.4 million for fiscal 2014.

Basic and diluted earnings per common share for fiscal 2015 were $18.21, compared with $17.51 for

fiscal 2014.

The weighted average common shares outstanding basic and diluted were 19,586,633 for fiscal 2015,

compared with 19,558,758 for fiscal 2014.