U-Haul 2016 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

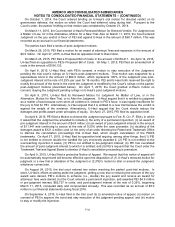

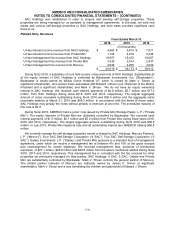

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (CONTINUED)

F-29

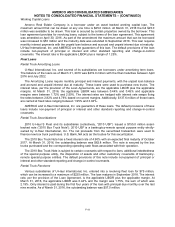

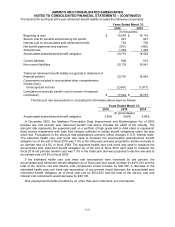

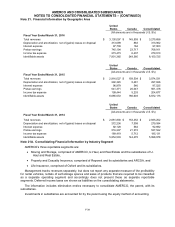

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input

that is significant to the fair value measurement. The following tables represent the financial assets and

liabilities on the condensed consolidated balance sheet at March 31, 2016 and 2015, that are subject to

ASC 820 and the valuation approach applied to each of these items.

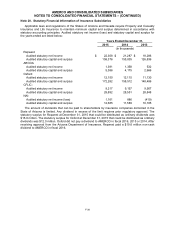

Year Ended March 31, 2016

Total

Level 1

Level 2

Level 3

(In thousands)

Assets

Short-term investments

$

499,491

$

499,491

$

–

$

–

Fixed maturities - available for sale

1,466,941

96,328

1,370,275

338

Preferred stock

18,428

18,428

–

–

Common stock

25,169

25,169

–

–

Derivatives

3,344

3,344

–

–

Total

$

2,013,373

$

642,760

$

1,370,275

$

338

Liabilities

Guaranteed residual values of TRAC leases

$

–

$

–

$

–

$

–

Derivatives

14,845

–

14,845

–

Total

$

14,845

$

–

$

14,845

$

–

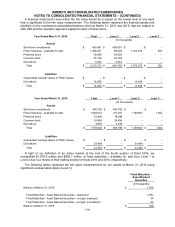

Year Ended March 31, 2015

Total

Level 1

Level 2

Level 3

(In thousands)

Assets

Short-term investments

$

460,762

$

460,762

$

–

$

–

Fixed maturities - available for sale

1,262,012

101,201

1,159,807

1,004

Preferred stock

18,296

18,296

–

–

Common stock

24,654

24,654

–

–

Derivatives

4,876

4,876

–

–

Total

$

1,770,600

$

609,789

$

1,159,807

$

1,004

Liabilities

Guaranteed residual values of TRAC leases

$

–

$

–

$

–

$

–

Derivatives

24,484

–

24,484

–

Total

$

24,484

$

–

$

24,484

$

–

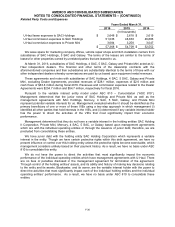

In light of our definition of an active market at the end of the fourth quarter of fiscal 2016, we

reclassified $1,079.0 million and $895.7 million of fixed maturities – available for sale from Level 1 to

Level 2 due to a review of their trading activity for fiscal 2016 and 2015, respectively.

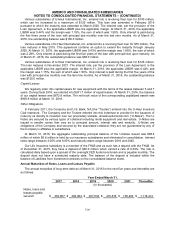

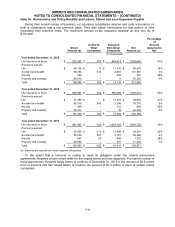

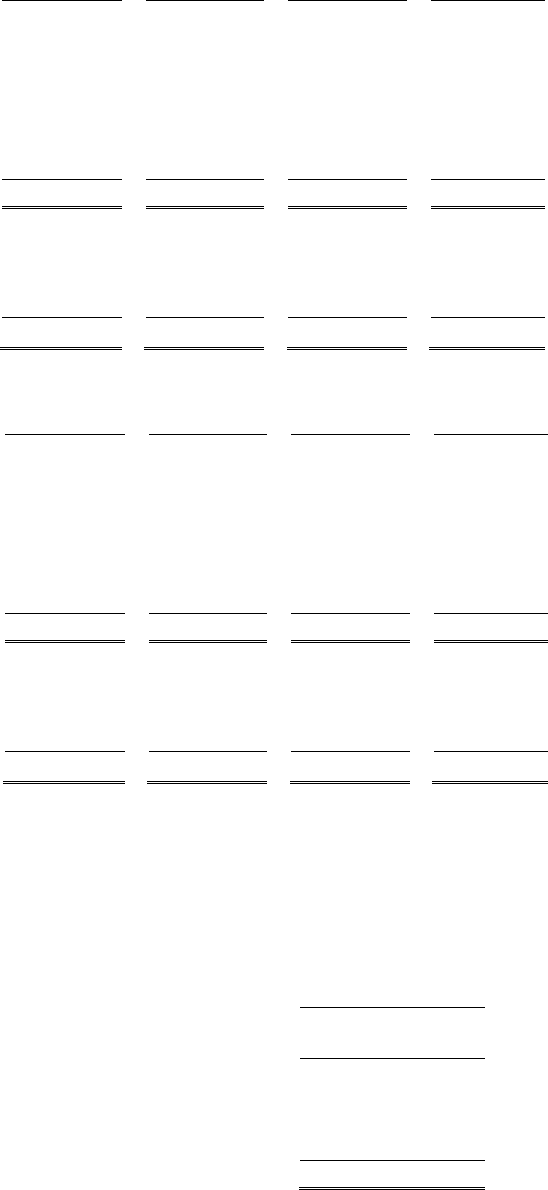

The following tables represent the fair value measurements for our assets at March 31, 2016 using

significant unobservable inputs (Level 3).

Fixed Maturities -

Asset Backed

Securities

(In thousands)

Balance at March 31, 2015

$

1,004

Fixed Maturities - Asset Backed Securities - redeemed

(753)

Fixed Maturities - Asset Backed Securities - net gain (realized)

34

Fixed Maturities - Asset Backed Securities - net gain (unrealized)

53

Balance at March 31, 2016

$

338