U-Haul 2016 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (CONTINUED)

F-20

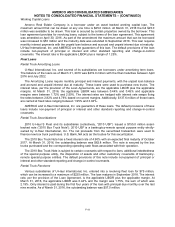

Various subsidiaries of U-Haul International, Inc. entered into a revolving fleet loan for $100 million,

which can be increased to a maximum of $125 million. This loan was amended in February 2016

pursuant to which the maturity was extended to March 2020. The interest rate, per the provision of the

Loan Agreement, is the applicable LIBOR plus the applicable margin. At March 31, 2016, the applicable

LIBOR was 0.44% and the margin was 1.15%, the sum of which was 1.59%. Only interest is paid during

the first three years of the loan with principal due monthly over the last nine months. As of March 31,

2016, the outstanding balance was $100.0 million.

Various subsidiaries of U-Haul International, Inc. entered into a revolving fleet loan for $70 million. The

loan matures in May 2019. This agreement contains an option to extend the maturity through January

2020. At March 31, 2016, the applicable LIBOR was 0.43% and the margin was 1.85%, the sum of which

was 2.28%. Only interest is paid during the first five years of the loan with principal due upon maturity. As

of March 31, 2016, the outstanding balance was $65.0 million.

Various subsidiaries of U-Haul International, Inc. entered into a revolving fleet loan for $125 million.

The loan matures in November 2021. The interest rate, per the provision of the Loan Agreement, is the

applicable LIBOR plus the applicable margin. At March 31, 2016, the applicable LIBOR was 0.44% and

the margin was 1.15%, the sum of which was 1.59%. Only interest is paid during the first five years of the

loan with principal due monthly over the last nine months. As of March 31, 2016, the outstanding balance

was $125.0 million.

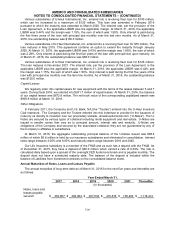

Capital Leases

We regularly enter into capital leases for new equipment with the terms of the leases between 5 and 7

years. During fiscal 2016, we entered into $241.7 million of capial leases. At March 31, 2016, the balance

of our capital leases was $672.8 million. The net book value of the corresponding capitalized assets was

$900.6 million at March 31, 2016.

Other Obligations

In February 2011, the Company and U.S. Bank, NA (the “Trustee”) entered into the U-Haul Investors

Club Indenture. The Company and the Trustee entered into this indenture to provide for the issuance of

notes by us directly to investors over our proprietary website, uhaulinvestorsclub.com (“U-Notes”). The U-

Notes are secured by various types of collateral including rental equipment and real estate. U-Notes are

issued in smaller series that vary as to principal amount, interest rate and maturity. U-Notes are

obligations of the Company and secured by the associated collateral; they are not guaranteed by any of

the Company’s affiliates or subsidiaries.

At March 31, 2016, the aggregate outstanding principal balance of the U-Notes issued was $65.8

million of which $5.6 million is held by our insurance subsidiaries and eliminated in consolidation. Interest

rates range between 3.00% and 8.00% and maturity dates range between 2016 and 2045.

Our Life Insurance subsidiary is a member of the FHLB and as such has a deposit with the FHLB. As

of December 31, 2015, they have a deposit of $30.0 million which carried a rate of 0.39%. The rate is

calculated daily based upon a spread of the overnight FED funds benchmark and is payable monthly. The

deposit does not have a scheduled maturity date. The balance of the deposit is included within the

balance of Liabilities from investment contracts on the consolidated balance sheet.

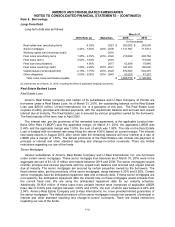

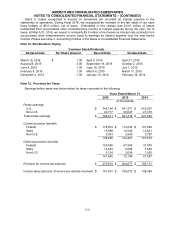

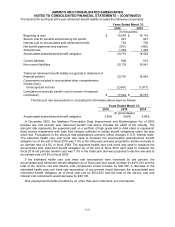

Annual Maturities of Notes, Loans and Leases Payable

The annual maturities of long-term debt as of March 31, 2016 for the next five years and thereafter are

as follows:

Year Ended March 31,

2017

2018

2019

2020

2021

Thereafter

(In thousands)

Notes, loans and

leases payable,

secured

$

353,807

$

348,984

$

297,534

$

416,616

$

155,403

$

1,116,414