U-Haul 2016 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

The available-for-sale securities held by the Company are recorded at fair value. These values are

determined primarily from actively traded markets where prices are based either on direct market quotes

or observed transactions. Liquidity is a factor considered during the determination of the fair value of

these securities. Market price quotes may not be readily available for certain securities or the market for

them has slowed or ceased. In situations where the market is determined to be illiquid, fair value is

determined based upon limited available information and other factors including expected cash flows. At

March 31, 2016, we had $0.3 million of available-for-sale assets classified in Level 3.

The interest rate swaps held by us as hedges against interest rate risk for our variable rate debt are

recorded at fair value. These values are determined using pricing valuation models which include broker

quotes for which significant inputs are observable. They include adjustments for counterparty credit

quality and other deal-specific factors, where appropriate and are classified as Level 2.

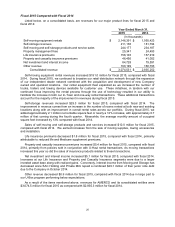

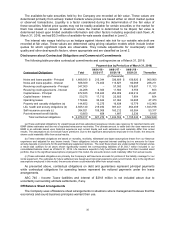

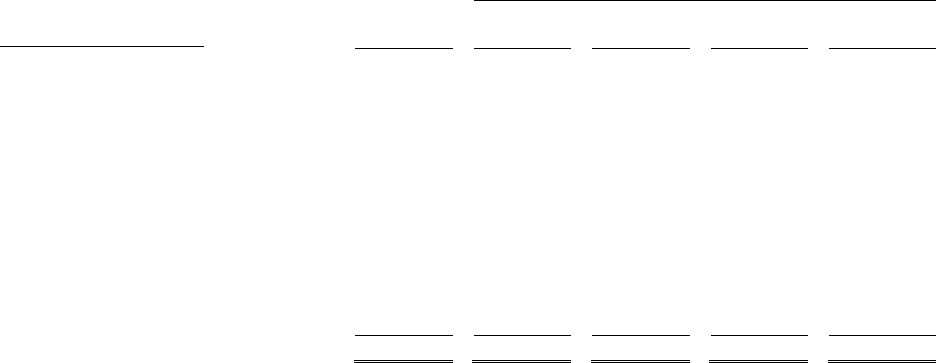

Disclosures about Contractual Obligations and Commercial Commitments

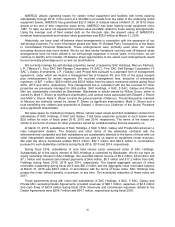

The following table provides contractual commitments and contingencies as of March 31, 2016:

Payment due by Period (as of March 31, 2016)

Contractual Obligations

Total

04/01/16 -

03/31/17

04/01/17 -

03/31/19

04/01/19 -

03/31/21

Thereafter

(In thousands)

Notes and loans payable - Principal

$

1,668,933

$

215,344

336,609

$

156,920

$

960,060

Notes and loans payable - Interest

566,309

72,402

113,627

92,069

288,211

Revolving credit agreements - Principal

347,000

–

57,000

178,887

111,113

Revolving credit agreements - Interest

24,268

6,300

11,560

5,755

653

Capital leases - Principal

672,825

138,463

252,909

236,212

45,241

Capital leases - Interest

50,275

17,712

23,805

7,904

854

Operating leases

179,844

36,622

61,064

34,685

47,473

Property and casualty obligations (a)

144,652

12,275

16,638

12,779

102,960

Life, health and annuity obligations (b)

2,925,140

219,492

397,441

364,409

1,943,798

Self insurance accruals (c)

384,921

108,008

160,212

63,384

53,317

Post retirement benefit liability

13,850

658

1,687

2,336

9,169

Total contractual obligations

$

6,978,017

$

827,276

$

1,432,552

$

1,155,340

$

3,562,849

(a) These estimated obligations for unpaid losses and loss adjustment expenses include case reserves for reported claims and

IBNR claims estimates and are net of expected reinsurance recoveries. The ultimate amount to settle both the case reserves and

IBNR is an estimate based upon historical experience and current trends and such estimates could materially differ from actual

results. The assumptions do not include future premiums. Due to the significant assumptions employed in this model, the amounts

shown could materially differ from actual results.

(b) These estimated obligations are based on mortality, morbidity, withdrawal and lapse assumptions drawn from our historical

experience and adjusted for any known trends. These obligations include expected interest crediting but no amounts for future

annuity deposits or premiums for life and Medicare supplement policies. The cash flows shown are undiscounted for interest and as

a result total outflows for all years shown significantly exceed the corresponding liabilities of $1,383.7 million included in our

consolidated balance sheet as of March 31, 2016. Life Insurance expects to fully fund these obligations from their invested asset

portfolio. Due to the significant assumptions employed in this model, the amounts shown could materially differ from actual results.

(c) These estimated obligations are primarily the Company’s self insurance accruals for portions of the liability coverage for our

rental equipment. The estimates for future settlement are based upon historical experience and current trends. Due to the significant

assumptions employed in this model, the amounts shown could materially differ from actual results.

As presented above, contractual obligations on debt and guarantees represent principal payments

while contractual obligations for operating leases represent the notional payments under the lease

arrangements.

ASC 740 - Income Taxes liabilities and interest of $29.8 million is not included above due to

uncertainty surrounding ultimate settlements, if any.

Off Balance Sheet Arrangements

The Company uses off-balance sheet arrangements in situations where management believes that the

economics and sound business principles warrant their use.