U-Haul 2016 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

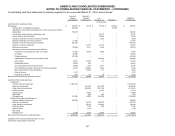

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (CONTINUED)

F-39

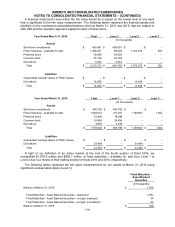

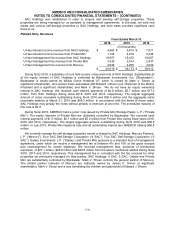

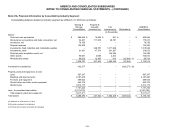

Note 21. Financial Information by Geographic Area

United

States

Canada

Consolidated

(All amounts are in thousands U.S. $'s)

Fiscal Year Ended March 31, 2016

Total revenues

$

3,130,097

$

145,559

$

3,275,656

Depreciation and amortization, net of (gains) losses on disposal

313,099

863

313,962

Interest expense

97,739

164

97,903

Pretax earnings

745,194

23,717

768,911

Income tax expense

273,473

6,437

279,910

Identifiable assets

7,901,365

249,360

8,150,725

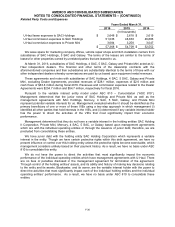

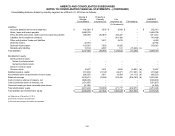

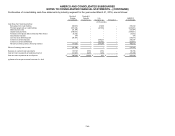

United

States

Canada

Consolidated

(All amounts are in thousands U.S. $'s)

Fiscal Year Ended March 31, 2015

Total revenues

$

2,916,027

$

158,504

$

3,074,531

Depreciation and amortization, net of (gains) losses on disposal

292,345

5,481

297,826

Interest expense

96,979

546

97,525

Pretax earnings

541,371

20,047

561,418

Income tax expense

199,444

5,233

204,677

Identifiable assets

6,685,572

186,603

6,872,175

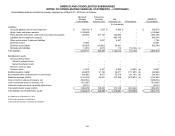

United

States

Canada

Consolidated

(All amounts are in thousands U.S. $'s)

Fiscal Year Ended March 31, 2014

Total revenues

$

2,681,800

$

153,452

$

2,835,252

Depreciation and amortization, net of (gains) losses on disposal

272,236

7,358

279,594

Interest expense

92,128

564

92,692

Pretax earnings

516,207

21,315

537,522

Income tax expense

189,419

5,712

195,131

Identifiable assets

5,854,503

144,475

5,998,978

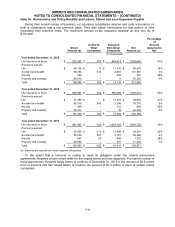

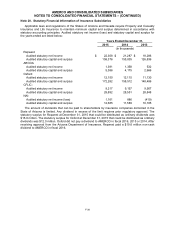

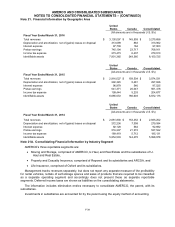

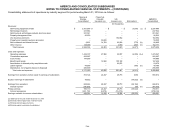

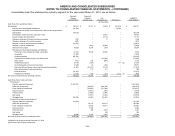

Note 21A. Consolidating Financial Information by Industry Segment

AMERCO’s three reportable segments are:

Moving and Storage, comprised of AMERCO, U-Haul, and Real Estate and the subsidiaries of U-

Haul and Real Estate,

Property and Casualty Insurance, comprised of Repwest and its subsidiaries and ARCOA, and

Life Insurance, comprised of Oxford and its subsidiaries.

Management tracks revenues separately, but does not report any separate measure of the profitability

for rental vehicles, rentals of self-storage spaces and sales of products that are required to be classified

as a separate operating segment and accordingly does not present these as separate reportable

segments. Deferred income taxes are shown as liabilities on the consolidating statements.

The information includes elimination entries necessary to consolidate AMERCO, the parent, with its

subsidiaries.

Investments in subsidiaries are accounted for by the parent using the equity method of accounting.