U-Haul 2016 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

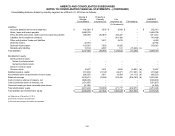

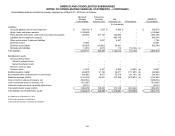

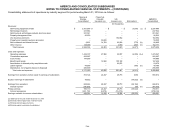

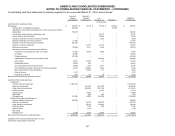

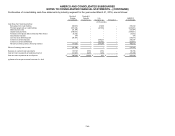

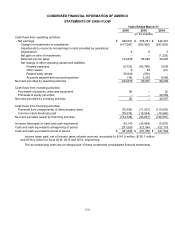

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (CONTINUED)

F-51

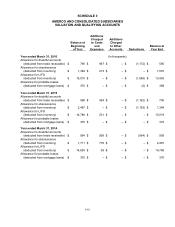

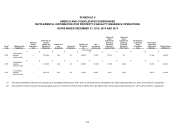

Consolidating cash flow statements by industry segment for the year ended March 31, 2014 are as follows:

Moving &

Storage

Consolidated

Property &

Casualty

Insurance (a)

Life

Insurance (a)

Elimination

AMERCO

Consolidated

(In thousands)

Cash flows from operating activities:

Net earnings

$

342,391

$

12,662

$

17,330

$

(29,992)

$

342,391

Earnings from consolidated subsidiaries

(29,992)

–

–

29,992

–

Adjustments to reconcile net earnings to the cash provided by operations:

Depreciation

293,169

–

–

–

293,169

Amortization of deferred policy acquisition costs

–

–

19,982

–

19,982

Interest credited to policyholders

–

–

22,890

–

22,890

Change in allowance for losses on trade receivables

(28)

–

(8)

–

(36)

Change in allowance for inventory reserve

871

–

–

–

871

Net gain on sale of real and personal property

(33,557)

–

–

–

(33,557)

Net gain on sale of investments

(1,325)

(536)

(4,550)

–

(6,411)

Deferred income taxes

34,605

7,301

4,465

–

46,371

Net change in other operating assets and liabilities:

Reinsurance recoverables and trade receivables

14,328

43,675

4,503

–

62,506

Inventories

(11,495)

–

–

–

(11,495)

Prepaid expenses

2,186

–

–

–

2,186

Capitalization of deferred policy acquisition costs

–

–

(32,611)

–

(32,611)

Other assets

8,670

(781)

(222)

–

7,667

Related party assets

11,060

(4,231)

–

725

(b)

7,554

Accounts payable and accrued expenses

32,394

62

3,909

–

36,365

Policy benefits and losses, claims and loss expenses payable

(8,202)

(34,968)

12,674

–

(30,496)

Other policyholders' funds and liabilities

–

513

118

–

631

Deferred income

1,259

–

–

–

1,259

Related party liabilities

5,647

(131)

(61)

(725)

(b)

4,730

Net cash provided (used) by operating activities

661,981

23,566

48,419

–

733,966

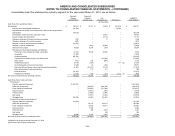

Cash flows from investing activities:

Purchases of:

Property, plant and equipment

(1,000,243)

–

–

–

(1,000,243)

Short term investments

–

(60,551)

(210,139)

–

(270,690)

Fixed maturities investments

–

(58,790)

(223,634)

–

(282,424)

Equity securities

–

(746)

(816)

–

(1,562)

Preferred stock

–

(640)

–

–

(640)

Real estate

–

–

(532)

–

(532)

Mortgage loans

(21,349)

(3,500)

(39,159)

11,589

(b)

(52,419)

Proceeds from sales and paydowns of:

Property, plant and equipment

270,053

–

–

–

270,053

Short term investments

–

68,852

200,200

–

269,052

Fixed maturities investments

–

17,106

121,295

–

138,401

Equity securities

26,569

2,570

–

–

29,139

Preferred stock

–

4,504

1,500

–

6,004

Real estate

193

–

351

–

544

Mortgage loans

38,959

6,267

15,049

(11,589)

(b)

48,686

Net cash provided (used) by investing activities

(685,818)

(24,928)

(135,885)

–

(846,631)

(a) Balance for the period ended December 31, 2013

(b) Eliminate intercompany investments