U-Haul 2016 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (CONTINUED)

F-34

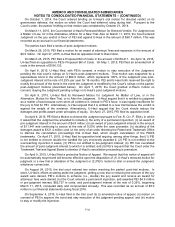

On September 8, 2015, the trial court entered an Order granting U-Haul’s Motion on Consent to

Approve Bond and Stay Execution of Judgment. The Judgment, as amended by the trial court’s orders

adding an award of costs and pre-judgment interest, is stayed pending resolution of appeals.

On October 15, 2015, the trial court denied U-Haul’s motion to modify or stay the injunction pending

appeal. But in the process, the Court clarified that (i) the reach of the injunction is limited to

“advertising, promoting, marketing, or describing any products or services” and (ii) use of the terms “pod”

and “pods” in comparative advertising is not prohibited, thereby allowing “nominative fair use" and truthful

communications in customer dialogue and making clear that “nothing in the injunction mandates

censorship with respect to consumer comments.”

PEI’s deadline for filing a notice of cross-appeal was September 23, 2015, and PEI did not file a notice

of cross-appeal.

On September 23, 2015, the Eleventh Circuit Court of Appeals granted the parties’ joint motion for an

extension of time for filing their respective briefs on appeal. U-Haul’s initial brief was due on December

17, 2015, PEI’s response brief was due on March 16, 2016, and U-Haul’s reply was due on April 29,

2016.

On September 24, 2015, the Eleventh Circuit Court of Appeals issued a Notice setting a telephonic

mediation for November 16, 2015, beginning at 2:00 p.m., Eastern Time. The mediation was

unsuccessful.

U-Haul filed its opening brief on appeal with the Eleventh Circuit Court of Appeals on December 17,

2015. PEI filed its response brief on March 16, 2016. U-Haul filed its reply brief on April 29, 2016. U-Haul

has requested oral argument, PEI did not oppose that request, and the Eleventh Circuit Court of Appeals

has not yet acted on that request.

Environmental

Compliance with environmental requirements of federal, state and local governments may significantly

affect Real Estate’s business operations. Among other things, these requirements regulate the discharge

of materials into the air, land and water and govern the use and disposal of hazardous substances. Real

Estate is aware of issues regarding hazardous substances on some of its properties. Real Estate

regularly makes capital and operating expenditures to stay in compliance with environmental laws and

has put in place a remedial plan at each site where it believes such a plan is necessary. Since 1988, Real

Estate has managed a testing and removal program for underground storage tanks.

Based upon the information currently available to Real Estate, compliance with the environmental laws

and its share of the costs of investigation and cleanup of known hazardous waste sites are not expected

to result in a material adverse effect on AMERCO’s financial position or results of operations.

Other

We are named as a defendant in various other litigation and claims arising out of the normal course of

business. In management’s opinion, none of these other matters will have a material effect on our

financial position and results of operations.

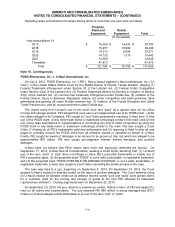

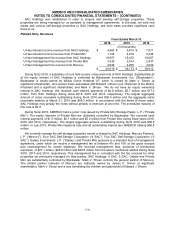

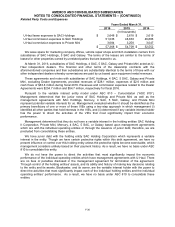

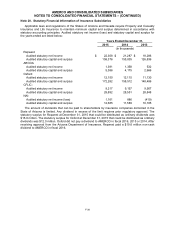

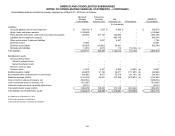

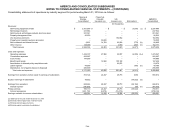

Note 19. Related Party Transactions

As set forth in the Audit Committee Charter and consistent with NASDAQ Listing Rules, our Audit

Committee (the “Audit Committee”) reviews and maintains oversight over related party transactions which

are required to be disclosed under the Securities and Exchange Commission (“SEC”) rules and

regulations and in accordance to GAAP. Accordingly, all such related party transactions are submitted to

the Audit Committee for ongoing review and oversight. Our internal processes are designed to ensure

that our legal and finance departments identify and monitor potential related party transactions that may

require disclosure and Audit Committee oversight.

AMERCO has engaged in related party transactions and has continuing related party interests with

certain major stockholders, directors and officers of the consolidated group as disclosed below.

Management believes that the transactions described below and in the related notes were completed on

terms substantially equivalent to those that would prevail in third party, arm’s-length transactions.