U-Haul 2016 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

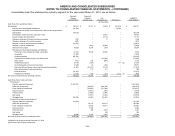

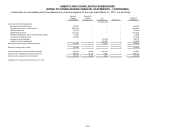

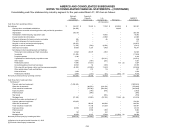

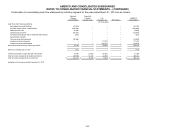

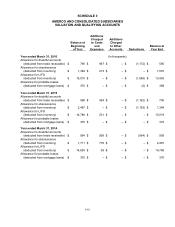

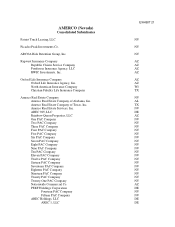

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (CONTINUED)

F-52

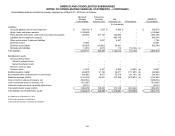

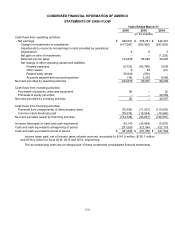

Continuation of consolidating cash flow statements by industry segment for the year ended March 31, 2014 are as follows:

Moving &

Storage

Consolidated

Property &

Casualty

Insurance (a)

Life

Insurance (a)

Elimination

AMERCO

Consolidated

(In thousands)

Cash flows from financing activities:

Borrowings from credit facilities

431,029

–

–

–

431,029

Principal repayments on credit facilities

(293,068)

–

–

–

(293,068)

Debt issuance costs

(3,943)

–

–

–

(3,943)

Capital lease payments

(53,079)

–

–

–

(53,079)

Purchases of Employee Stock Ownership Plan Shares

(207)

–

–

–

(207)

Securitization deposits

–

–

–

–

–

Common stock dividends paid

(19,568)

–

–

–

(19,568)

Investment contract deposits

–

–

117,723

–

117,723

Investment contract withdrawals

–

–

(34,677)

–

(34,677)

Net cash provided (used) by financing activities

61,164

–

83,046

–

144,210

Effects of exchange rate on cash

(177)

–

–

–

(177)

Increase (decrease) in cash and cash equivalents

37,150

(1,362)

(4,420)

–

31,368

Cash and cash equivalents at beginning of period

427,560

14,120

22,064

–

463,744

Cash and cash equivalents at end of period

$

464,710

$

12,758

$

17,644

$

–

$

495,112

(a) Balance for the period ended December 31, 2013