U-Haul 2016 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (CONTINUED)

F-8

Property and Casualty Insurance includes Repwest and its wholly-owned subsidiaries and ARCOA

Risk Retention Group (“ARCOA”). Property and Casualty Insurance provides loss adjusting and claims

handling for U-Haul through regional offices across North America. Property and Casualty Insurance also

underwrites components of the Safemove, Safetow, Safemove Plus, Safestor and Safestor Mobile

protection packages to U-Haul customers. The business plan for Property and Casualty Insurance

includes offering property and casualty products in other U-Haul related programs. ARCOA is a group

captive insurer owned by us and our wholly-owned subsidiaries whose purpose is to provide insurance

products related to the moving and storage business.

Life Insurance includes Oxford and its wholly-owned subsidiaries. Life Insurance provides life and

health insurance products primarily to the senior market through the direct writing and reinsuring of life

insurance, Medicare supplement and annuity policies.

Note 3. Accounting Policies

Use of Estimates

The preparation of financial statements in conformity with the generally accepted accounting principles

(“GAAP”) in the United States requires management to make estimates and judgments that affect the

amounts reported in the financial statements and accompanying notes. The accounting policies that we

deem most critical to us and that require management’s most difficult and subjective judgments include

the principles of consolidation, the recoverability of property, plant and equipment, the adequacy of

insurance reserves, the recognition and measurement of impairments for investments accounted for

under ASC 320 - Investments - Debt and Equity Securities and the recognition and measurement of

income tax assets and liabilities. The actual results experienced by us may differ from management’s

estimates.

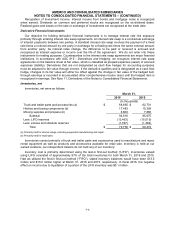

Cash and Cash Equivalents

We consider cash equivalents to be highly liquid debt securities with insignificant interest rate risk with

original maturities from the date of purchase of three months or less.

Financial instruments that potentially subject us to concentrations of credit risk consist principally of

cash deposits. Accounts at each United States financial institution are insured by the Federal Deposit

Insurance Corporation up to $250,000. Accounts at each Canadian financial institution are insured by the

Canada Deposit Insurance Corporation up to $100,000 CAD per account. At March 31, 2016 and March

31, 2015, we held cash equivalents in excess of these insured limits. To mitigate this risk, we select

financial institutions based on their credit ratings and financial strength.

Investments

Fixed Maturities and Marketable Equities. Fixed maturity investments consist of either marketable

debt, equity or redeemable preferred stocks. As of the balance sheet dates, all of our investments in

these securities were classified as available-for-sale. Available-for-sale investments are reported at fair

value, with unrealized gains or losses recorded net of taxes and applicable adjustments to deferred policy

acquisition costs in stockholders’ equity. Fair value for these investments is based on quoted market

prices, dealer quotes or discounted cash flows. The cost of investments sold is based on the specific

identification method.

In determining if and when a decline in market value below carrying value is an other-than-temporary

impairment, management makes certain assumptions or judgments in its assessment including but not

limited to: our ability to hold the security, quoted market prices, dealer quotes, discounted cash flows,

industry factors, financial factors, and issuer specific information. Other-than-temporary impairments, to

the extent of the decline, as well as realized gains or losses on the sale or exchange of investments are

recognized in the current period operating results.

Mortgage Loans and Notes on Real Estate. Mortgage loans and notes on real estate are reported at

their unpaid balance, net of any allowance for possible losses and any unamortized premium or discount.