U-Haul 2016 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

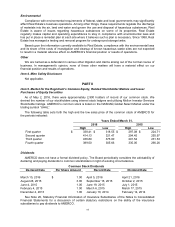

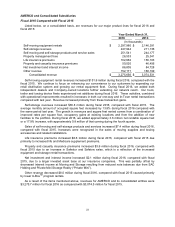

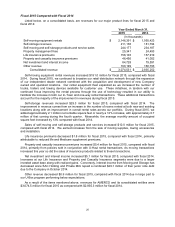

Item 6. Selected Financial Data

The following selected financial data should be read in conjunction with the MD&A, and the

Consolidated Financial Statements and related notes in this Annual Report.

Listed below is selected financial data for AMERCO and consolidated subsidiaries for each of the last

five years:

Years Ended March 31,

2016

2015

2014

2013

2012

(In thousands, except share and per share data)

Summary of Operations:

Self-moving equipment rentals

$

2,297,980

$

2,146,391

$

1,955,423

$

1,767,520

$

1,678,256

Self-storage revenues

247,944

211,136

181,794

152,660

134,376

Self-moving and self-storage products and service sales

251,541

244,177

234,187

221,117

213,854

Property management fees

26,533

25,341

24,493

24,378

23,266

Life insurance premiums

162,662

156,103

157,919

178,115

277,562

Property and casualty insurance premiums

50,020

46,456

41,052

34,342

32,631

Net investment and interest income

86,805

84,728

79,591

82,903

73,552

Other revenue

152,171

160,199

160,793

97,552

78,530

Total revenues

3,275,656

3,074,531

2,835,252

2,558,587

2,512,027

Operating expenses

1,470,047

1,479,409

1,313,674

1,193,934

1,115,126

Commission expenses

262,627

249,642

227,332

204,758

190,254

Cost of sales

144,990

146,072

127,270

107,216

116,542

Benefits and losses

167,436

158,760

156,702

180,676

320,191

Amortization of deferred policy acquisition costs

23,272

19,661

19,982

17,376

13,791

Lease expense

49,780

79,798

100,466

117,448

131,215

Depreciation, net of (gains) losses on disposals (b)

290,690

278,165

259,612

237,996

208,901

Total costs and expenses

2,408,842

2,411,507

2,205,038

2,059,404

2,096,020

Earnings from operations

866,814

663,024

630,214

499,183

416,007

Interest expense

(97,903)

(97,525)

(92,692)

(90,696)

(90,371)

Fees and amortization on early extinguishment of debt

–

(4,081)

–

–

–

Pretax earnings

768,911

561,418

537,522

408,487

325,636

Income tax expense

(279,910)

(204,677)

(195,131)

(143,779)

(120,269)

Net earnings

489,001

356,741

342,391

264,708

205,367

Less: Excess of redemption value over carrying value of preferred shares redeemed

–

–

–

–

(5,908)

Less: Preferred stock dividends (a)

–

–

–

–

(2,913)

Earnings available to common shareholders

$

489,001

$

356,741

$

342,391

$

264,708

$

196,546

Basic and diluted earnings per common share

$

24.95

$

18.21

$

17.51

$

13.56

$

10.09

Weighted average common shares outstanding: Basic and diluted

19,596,110

19,586,633

19,558,758

19,518,779

19,476,187

Cash dividends declared and accrued Preferred stock (a)

$

–

$

–

$

–

$

–

$

2,913

Cash dividends declared and accrued Common stock

97,960

19,594

19,568

97,421

–

Balance Sheet Data:

Property, plant and equipment, net

$

5,017,511

$

4,107,637

$

3,409,211

$

2,755,054

$

2,372,365

Total assets

8,150,725

6,872,175

5,998,978

5,306,601

4,654,051

Notes, loans and leases payable

2,688,758

2,190,869

1,942,359

1,661,845

1,486,211

Stockholders' equity

2,251,406

1,884,359

1,527,368

1,229,259

1,035,820

(a) Fiscal 2012 reflects the elimination of $0.3 million paid to affiliates.

(b) (Gains) losses were ($98.7) million, ($74.6) million, ($33.6) million, ($22.5) million and ($20.9) million for fiscal 2016, 2015, 2014, 2013 and 2012, respectively.