U-Haul 2016 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

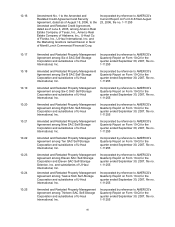

F-6

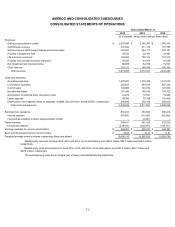

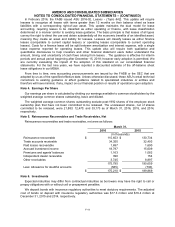

AMERCO AND CONSOLIDATED SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years Ended March 31,

2016

2015

2014

(In thousands)

Cash flows from operating activities:

Net earnings

$

489,001

$

356,741

$

342,391

Adjustments to reconcile net earnings to cash provided by operations:

Depreciation

389,393

352,796

293,169

Amortization of deferred policy acquisition costs

23,272

19,661

19,982

Interest credited to policyholders

20,465

18,110

22,890

Change in allowance for losses on trade receivables

(205)

(168)

(36)

Change in allowance for inventory reserves

(1,343)

(872)

871

Net gain on sale of real and personal property

(98,703)

(74,631)

(33,557)

Net gain on sale of investments

(4,491)

(3,925)

(6,411)

Deferred income taxes

138,075

76,500

46,371

Net change in other operating assets and liabilities:

Reinsurance recoverables and trade receivables

14,765

9,632

62,506

Inventories

(9,009)

(1,579)

(11,495)

Prepaid expenses

(10,338)

(65,720)

2,186

Capitalization of deferred policy acquisition costs

(32,590)

(27,084)

(32,611)

Other assets

15,322

3,735

7,667

Related party assets

56,644

27,706

7,554

Accounts payable and accrued expenses

37,387

98,877

36,365

Policy benefits and losses, claims and loss expenses payable

9,626

(17,621)

(30,496)

Other policyholders' funds and liabilities

(349)

988

631

Deferred income

4,757

(13,181)

1,259

Related party liabilities

(616)

(866)

4,730

Net cash provided by operating activities

1,041,063

759,099

733,966

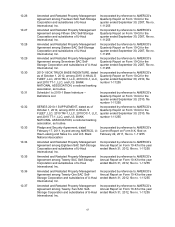

Cash flow from investing activities:

Purchase of:

Property, plant and equipment

(1,509,154)

(1,041,931)

(1,000,243)

Short term investments

(515,899)

(290,379)

(270,690)

Fixed maturity investments

(417,062)

(214,371)

(282,424)

Equity securities

(1,315)

(3,759)

(1,562)

Preferred stock

(1,005)

(2,006)

(640)

Real estate

(75)

(15,399)

(532)

Mortgage loans

(102,588)

(42,683)

(52,419)

Proceeds from sales and paydowns of:

Property, plant and equipment

539,256

411,629

270,053

Short term investments

528,180

287,883

269,052

Fixed maturity investments

154,536

107,867

138,401

Equity securities

2,044

3,082

29,139

Preferred stock

1,126

2,427

6,004

Real estate

–

396

544

Mortgage loans

48,557

41,983

48,686

Net cash used by investing activities

(1,273,399)

(755,261)

(846,631)

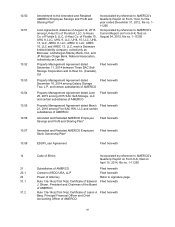

Cash flow from financing activities:

Borrowings from credit facilities

855,972

657,535

431,029

Principal repayments on credit facilities

(428,403)

(593,722)

(293,068)

Debt issuance costs

(10,184)

(12,327)

(3,943)

Capital lease payments

(168,661)

(121,202)

(53,079)

Purchases of Employee Stock Ownership Plan Shares

(9,302)

(7,939)

(207)

Securitization deposits

544

–

–

Common stock dividends paid

(78,374)

(19,594)

(19,568)

Investment contract deposits

298,237

105,019

117,723

Investment contract withdrawals

(52,957)

(54,108)

(34,677)

Net cash provided (used) by financing activities

406,872

(46,338)

144,210

Effects of exchange rate on cash

(15,740)

(10,762)

(177)

Increase (decrease) in cash and cash equivalents

158,796

(53,262)

31,368

Cash and cash equivalents at the beginning of period

441,850

495,112

463,744

Cash and cash equivalents at the end of period

$

600,646

$

441,850

$

495,112

The accompanying notes are an integral part of these consolidated financial statements.