U-Haul 2016 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

Environmental

Compliance with environmental requirements of federal, state and local governments may significantly

affect Real Estate’s business operations. Among other things, these requirements regulate the discharge

of materials into the air, land and water and govern the use and disposal of hazardous substances. Real

Estate is aware of issues regarding hazardous substances on some of its properties. Real Estate

regularly makes capital and operating expenditures to stay in compliance with environmental laws and

has put in place a remedial plan at each site where it believes such a plan is necessary. Since 1988, Real

Estate has managed a testing and removal program for underground storage tanks.

Based upon the information currently available to Real Estate, compliance with the environmental laws

and its share of the costs of investigation and cleanup of known hazardous waste sites are not expected

to result in a material adverse effect on AMERCO’s financial position or results of operations.

Other

We are named as a defendant in various other litigation and claims arising out of the normal course of

business. In management’s opinion, none of these other matters will have a material effect on our

financial position and results of operations.

Item 4. Mine Safety Disclosure

Not applicable.

PART II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

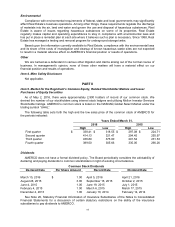

As of May 2, 2016, there were approximately 2,900 holders of record of our common stock. We

derived the number of our stockholders using internal stock ledgers and utilizing Mellon Investor Services

Stockholder listings. AMERCO’s common stock is listed on the NASDAQ Global Select Market under the

trading symbol “UHAL”.

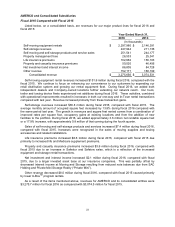

The following table sets forth the high and the low sales price of the common stock of AMERCO for

the periods indicated:

Years Ended March 31,

2016

2015

High

Low

High

Low

First quarter

$

338.41

$

318.55

$

297.08

$

224.71

Second quarter

414.13

321.47

294.45

255.97

Third quarter

436.89

375.00

291.54

231.53

Fourth quarter

389.00

305.66

335.00

266.26

Dividends

AMERCO does not have a formal dividend policy. The Board periodically considers the advisability of

declaring and paying dividends to common stockholders in light of existing circumstances.

Common Stock Dividends

Declared Date

Per Share Amount

Record Date

Dividend Date

March 15, 2016

$

1.00

April 5, 2016

April 21, 2016

August 28, 2015

3.00

September 16, 2015

October 2, 2015

June 4, 2015

1.00

June 19, 2015

July 1, 2015

February 4, 2015

1.00

March 6, 2015

March 17, 2015

December 4, 2013

1.00

January 10, 2014

February 14, 2014

See Note 20, Statutory Financial Information of Insurance Subsidiaries of the Notes to Consolidated

Financial Statements for a discussion of certain statutory restrictions on the ability of the insurance

subsidiaries to pay dividends to AMERCO.