U-Haul 2016 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (CONTINUED)

F-24

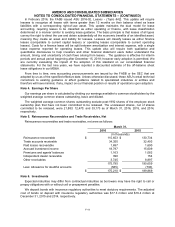

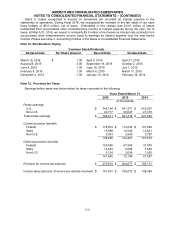

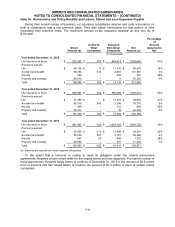

The difference between the tax provision at the statutory federal income tax rate and the tax provision

attributable to income before taxes was as follows:

Years Ended March 31,

2016

2015

2014

Statutory federal income tax rate

35.00%

35.00%

35.00%

Increase (reduction) in rate resulting from:

State taxes, net of federal benefit

2.34%

2.21%

2.38%

Foreign rate differential

(0.24)%

(0.32)%

(0.33)%

Federal tax credits

(0.19)%

(0.29)%

(0.32)%

Dividend received deduction

(0.02)%

(0.03)%

(0.03)%

Other

(0.49)%

(0.11)%

(0.40)%

Actual tax expense of operations

36.40%

36.46%

36.30%

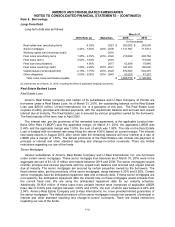

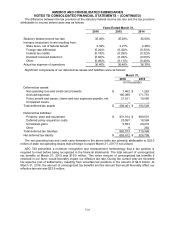

Significant components of our deferred tax assets and liabilities were as follows:

March 31,

2016

2015

(In thousands)

Deferred tax assets:

Net operating loss and credit carry forwards

$

1,462

$

1,228

Accrued expenses

185,088

171,761

Policy benefit and losses, claims and loss expenses payable, net

21,911

19,560

Unrealized losses

–

–

Total deferred tax assets

$

208,461

$

192,549

Deferred tax liabilities:

Property, plant and equipment

$

831,914

$

680,501

Deferred policy acquisition costs

20,557

18,369

Unrealized gains

9,593

20,216

Other

9

262

Total deferred tax liabilities

862,073

719,348

Net deferred tax liability

$

653,612

$

526,799

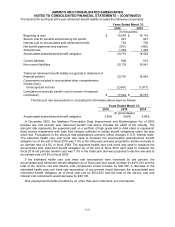

The net operating loss and credit carry-forwards in the above table are primarily attributable to $22.0

million of state net operating losses that will begin to expire March 31, 2017 if not utilized.

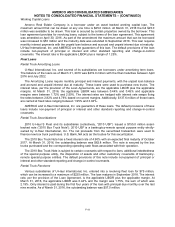

ASC 740 prescribes a minimum recognition and measurement methodology that a tax position is

required to meet before being recognized in the financial statements. The total amount of unrecognized

tax benefits at March 31, 2015 was $19.9 million. This entire amount of unrecognized tax benefits if

resolved in our favor, would favorably impact our effective tax rate. During the current year we recorded

tax expense (net of settlements), resulting from uncertain tax positions in the amount of $4.0 million. At

March 31, 2016, the amount of unrecognized tax benefits and the amount that would favorably affect our

effective tax rate was $23.9 million.