U-Haul 2016 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (CONTINUED)

F-25

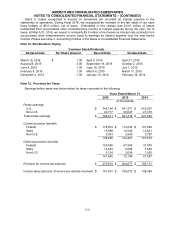

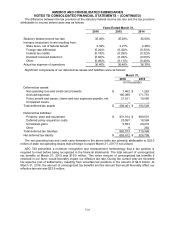

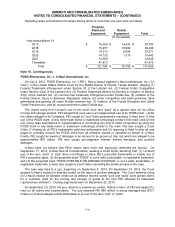

A reconciliation of the total amounts of unrecognized tax benefits at the beginning and end of the

period are as follows:

Unrecognized Tax Benefits

March 31,

2016

2015

(In thousands)

Unrecognized tax benefits beginning balance

$

19,929

$

16,850

Additions based on tax positions related to the current year

4,313

3,695

Reductions for tax positions of prior years

(327)

(616)

Settlements

(3)

–

Unrecognized tax benefits ending balance

$

23,912

$

19,929

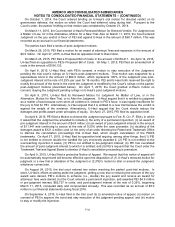

We recognize interest related to unrecognized tax benefits as interest expense, and penalties as

operating expenses. At March 31, 2015, the amount of interest and penalties accrued on unrecognized

tax benefits was $5.2 million, net of tax. During the current year we recorded expense from interest and

penalties in the amount of $0.7 million, net of tax. At March 31, 2016, the amount of interest and penalties

accrued on unrecognized tax benefits was $5.9 million, net of tax.

We file income tax returns in the U.S. federal jurisdiction, and various states and foreign jurisdictions.

With some exceptions, we are no longer subject to audit for years prior to the fiscal year ended March 31,

2013. No provision was made for U.S. taxes payable on undistributed foreign earnings since these

amounts are permanently reinvested; the amount of this unrecognized deferred tax liability is not practical

to determine at this time.

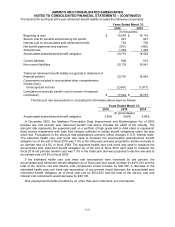

Note 14. Employee Benefit Plans

Profit Sharing Plans

We provide tax-qualified profit sharing retirement plans for the benefit of eligible employees, former

employees and retirees in the U.S. and Canada. The plans are designed to provide employees with an

accumulation of funds for retirement on a tax-deferred basis and provide for annual discretionary

employer contributions. Amounts to be contributed are determined by the President and Chairman of the

Board of the Company under the delegation of authority from the Board, pursuant to the terms of the

Profit Sharing Plan. No contributions were made to the profit sharing plan during fiscal 2016, 2015 or

2014.

We also provide an employee savings plan which allows participants to defer income under Section

401(k) of the Internal Revenue Code of 1986.

ESOP Plan

We sponsor a leveraged ESOP that generally covers all employees with one year or more of service.

The ESOP shares initially were pledged as collateral for its debt which was originally funded by U-Haul.

As the debt is repaid, shares are released from collateral and allocated to active employees, based on the

proportion of debt service paid in the year. ESOP shares are committed to be released monthly and

ESOP compensation expense is recorded based on the current market price at the end of the month.

These shares then become outstanding for the earnings per share computations. ESOP compensation

expense was $11.6 million, $6.9 million and $6.6 million for fiscal 2016, 2015 and 2014, respectively.

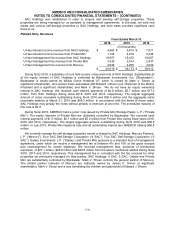

Listed below is a summary of these financing arrangements as of fiscal year-end:

Outstanding as of

Interest Payments

Financing Date

March 31, 2016

2016

2015

2014

(In thousands)

June, 1991

$

46

$

10

$

48

$

53

July, 2009

991

33

31

17

February, 2016

5,000

–

–

–