U-Haul 2016 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (CONTINUED)

F-14

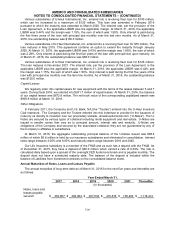

In February 2016, the FASB issued ASU 2016-02, Leases - (Topic 842). This update will require

lessees to recognize all leases with terms greater than 12 months on their balance sheet as lease

liabilities with a corresponding right-of-use asset. This update maintains the dual model for lease

accounting, requiring leases to be classified as either operating or finance, with lease classification

determined in a manner similar to existing lease guidance. The basic principle is that leases of all types

convey the right to direct the use and obtain substantially all the economic benefits of an identified asset,

meaning they create an asset and liability for lessees. Lessees will classify leases as either finance

leases (comparable to current capital leases) or operating leases (comparable to current operating

leases). Costs for a finance lease will be split between amortization and interest expense, with a single

lease expense reported for operating leases. This update also will require both qualitative and

quantitative disclosures to help investors and other financial statement users better understand the

amount, timing, and uncertainty of cash flows arising from leases. . The guidance is effective for interim

periods and annual period beginning after December 15, 2018; however early adoption is permitted. We

are currently evaluating the impact of the adoption of this standard on our consolidated financial

statements. For the last nine years, we have reported a discounted estimate of the off-balance sheet

lease obligations in our MD&A.

From time to time, new accounting pronouncements are issued by the FASB or the SEC that are

adopted by us as of the specified effective date. Unless otherwise discussed, these ASU’s entail technical

corrections to existing guidance or affect guidance related to specialized industries or entities and

therefore will have minimal, if any, impact on our financial position or results of operations upon adoption.

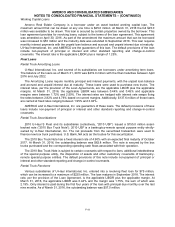

Note 4. Earnings Per Share

Our earnings per share is calculated by dividing our earnings available to common stockholders by the

weighted average common shares outstanding, basic and diluted.

The weighted average common shares outstanding exclude post-1992 shares of the employee stock

ownership plan that have not been committed to be released. The unreleased shares, net of shares

committed to be released, were 21,883; 12,470; and 33,173 as of March 31, 2016, 2015, and 2014,

respectively.

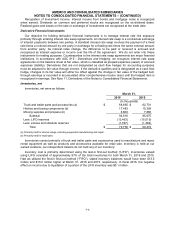

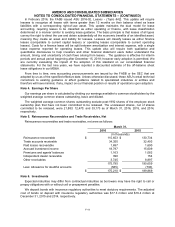

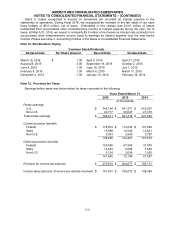

Note 5. Reinsurance Recoverables and Trade Receivables, Net

Reinsurance recoverables and trade receivables, net were as follows:

March 31,

2016

2015

(In thousands)

Reinsurance recoverable

$

115,653

$

130,734

Trade accounts receivable

34,350

32,493

Paid losses recoverable

1,697

1,690

Accrued investment income

18,797

15,609

Premiums and agents' balances

1,163

1,082

Independent dealer receivable

390

154

Other receivables

3,745

8,897

175,795

190,659

Less: Allowance for doubtful accounts

(585)

(790)

$

175,210

$

189,869

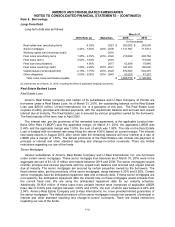

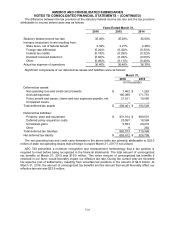

Note 6. Investments

Expected maturities may differ from contractual maturities as borrowers may have the right to call or

prepay obligations with or without call or prepayment penalties.

We deposit bonds with insurance regulatory authorities to meet statutory requirements. The adjusted

cost of bonds on deposit with insurance regulatory authorities was $17.3 million and $16.4 million at

December 31, 2015 and 2014, respectively.