U-Haul 2016 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

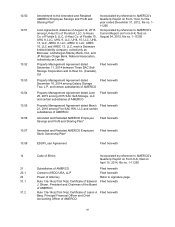

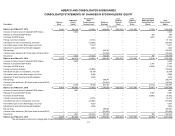

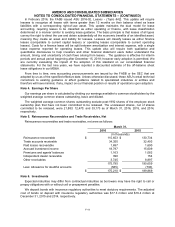

F-5

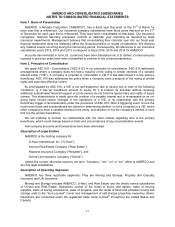

AMERCO AND CONSOLIDATED SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

Description

Common

Stock

Additional

Paid-In

Capital

Accumulated

Other

Comprehensive

Income (Loss)

Retained

Earnings

Less:

Treasury

Common

Stock

Less:

Treasury

Preferred

Stock

Less: Unearned

Employee Stock

Ownership Plan

Shares

Total

Stockholders'

Equity

(In thousands)

Balance as of March 31, 2013

$

10,497

$

438,168

$

(22,680)

$

1,482,630

$

(525,653)

$

(151,997)

$

(1,706)

$

1,229,259

Increase in market value of released ESOP shares

–

6,042

–

–

–

–

–

6,042

Release of unearned ESOP shares

–

–

–

–

–

–

694

694

Purchase of ESOP shares

–

–

–

–

–

–

(207)

(207)

Foreign currency translation

–

–

(9,134)

–

–

–

–

(9,134)

Unrealized net loss on investments, net of tax

–

–

(33,654)

–

–

–

–

(33,654)

Fair market value of cash flow hedges, net of tax

–

–

11,977

–

–

–

–

11,977

Adjustment to post retirement benefit obligation

–

–

(432)

–

–

–

–

(432)

Net earnings

–

–

–

342,391

–

–

–

342,391

Common stock dividend: ($1.00 per share for fiscal 2014)

–

–

–

(19,568)

–

–

–

(19,568)

Net activity

–

6,042

(31,243)

322,823

–

–

487

298,109

Balance as of March 31, 2014

$

10,497

$

444,210

$

(53,923)

$

1,805,453

$

(525,653)

(151,997)

$

(1,219)

$

1,527,368

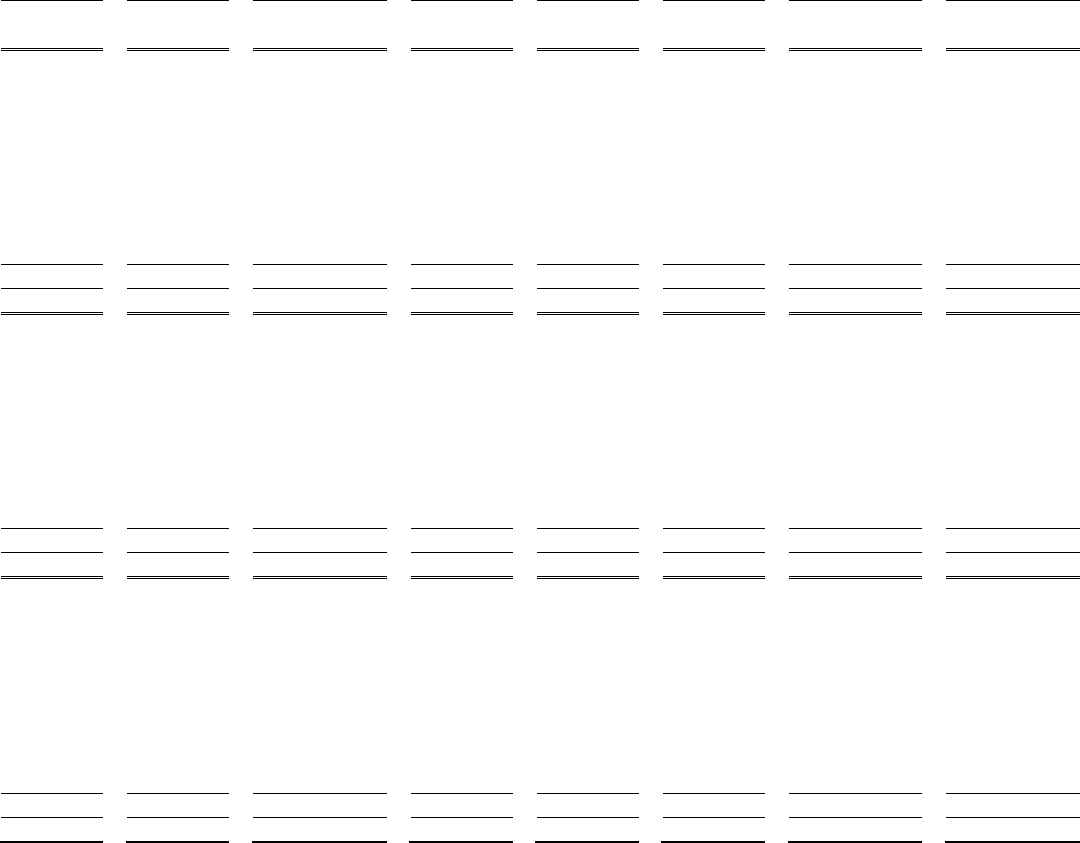

Increase in market value of released ESOP shares

–

5,458

–

–

–

–

–

5,458

Release of unearned ESOP shares

–

–

–

–

–

–

2,767

2,767

Purchase of ESOP shares

–

–

–

–

–

–

(7,939)

(7,939)

Foreign currency translation

–

–

(19,883)

–

–

–

–

(19,883)

Unrealized net gain on investments, net of tax

–

–

35,190

–

–

–

–

35,190

Fair market value of cash flow hedges, net of tax

–

–

5,086

–

–

–

–

5,086

Adjustment to post retirement benefit obligation

–

–

(835)

–

–

–

–

(835)

Net earnings

–

–

–

356,741

–

–

–

356,741

Common stock dividends: ($1.00 per share for fiscal 2015)

–

–

–

(19,594)

–

–

–

(19,594)

Net activity

–

5,458

19,558

337,147

–

–

(5,172)

356,991

Balance as of March 31, 2015

$

10,497

$

449,668

$

(34,365)

$

2,142,600

$

(525,653)

$

(151,997)

$

(6,391)

$

1,884,359

Increase in market value of released ESOP shares

–

1,961

–

–

–

–

–

1,961

Release of unearned ESOP shares

–

–

–

–

–

–

9,507

9,507

Purchase of ESOP shares

–

–

–

–

–

–

(9,302)

(9,302)

Foreign currency translation

–

–

(4,473)

–

–

–

–

(4,473)

Unrealized net loss on investments, net of tax

–

–

(27,066)

–

–

–

–

(27,066)

Fair market value of cash flow hedges, net of tax

–

–

6,027

–

–

–

–

6,027

Adjustment to post retirement benefit obligation

–

–

(648)

–

–

–

–

(648)

Net earnings

–

–

–

489,001

–

–

–

489,001

Common stock dividends: ($5.00 per share for fiscal 2016)

–

–

–

(97,960)

–

–

–

(97,960)

Net activity

–

1,961

(26,160)

391,041

–

–

205

367,047

Balance as of March 31, 2016

$

10,497

$

451,629

$

(60,525)

$

2,533,641

$

(525,653)

$

(151,997)

$

(6,186)

$

2,251,406

The accompanying notes are an integral part of these consolidated financial statements.