U-Haul 2016 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (CONTINUED)

F-31

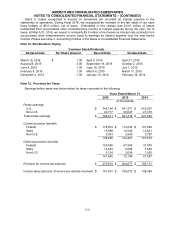

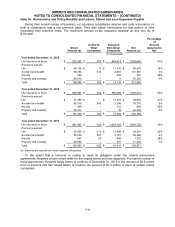

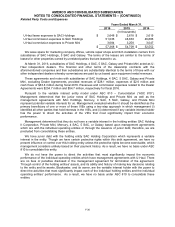

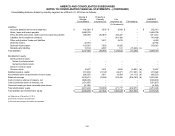

Policy benefits and losses, claims and loss expenses payable for Property and Casualty Insurance

were as follows:

December 31,

2015

2014

(In thousands)

Unpaid losses and loss adjustment expense

$

251,964

$

271,609

Reinsurance losses payable

855

135

Total

$

252,819

$

271,744

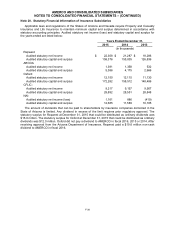

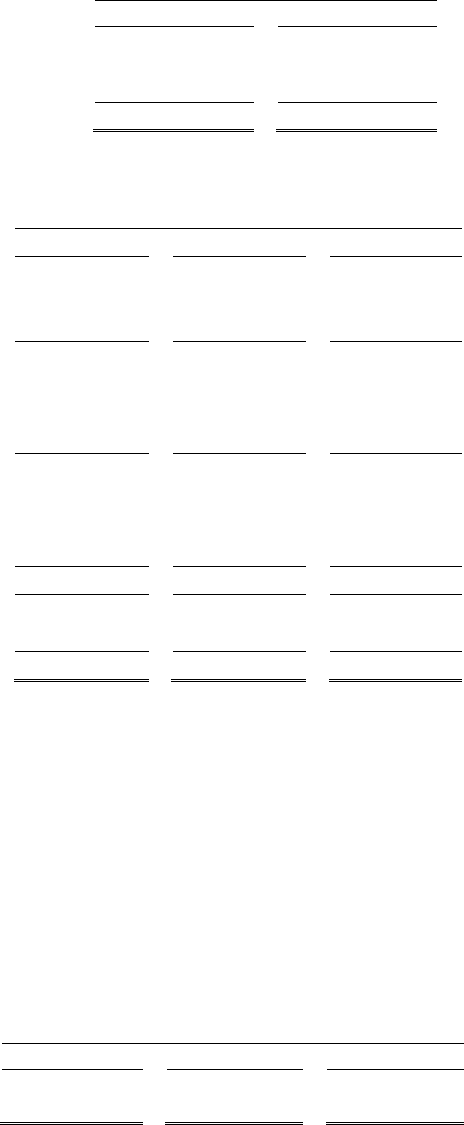

Activity in the liability for unpaid losses and loss adjustment expenses for Property and Casualty

Insurance is summarized as follows:

December 31,

2015

2014

2013

(In thousands)

Balance at January 1

$

271,609

$

295,126

$

330,093

Less: reinsurance recoverable

120,894

136,535

176,439

Net balance at January 1

150,715

158,591

153,654

Incurred related to:

Current year

12,214

11,690

9,861

Prior years

84

(694)

1,652

Total incurred

12,298

10,996

11,513

Paid related to:

Current year

7,509

6,155

5,226

Prior years

10,851

12,717

1,350

Total paid

18,360

18,872

6,576

Net balance at December 31

144,653

150,715

158,591

Plus: reinsurance recoverable

107,311

120,894

136,535

Balance at December 31

$

251,964

$

271,609

$

295,126

The liability for incurred losses and loss adjustment expenses (net of reinsurance recoverable of

$107.3 million) decreased by $6.1 million in 2015.

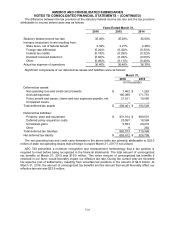

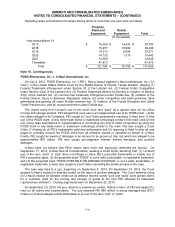

Note 17. Contingent Liabilities and Commitments

We lease a portion of our rental equipment and certain of our facilities under operating leases with

terms that expire at various dates substantially through 2019. As of March 31, 2016, we have guaranteed

$22.3 million of residual values for these rental equipment assets at the end of the respective lease

terms. Certain leases contain renewal and fair market value purchase options as well as mileage and

other restrictions. At the expiration of the lease, we have the option to renew the lease, purchase the

asset for fair market value, or sell the asset to a third party on behalf of the lessor. We have been leasing

equipment since 1987 and have experienced no material losses relating to these types of residual value

guarantees.

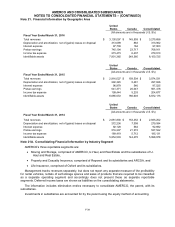

Lease expenses were as follows:

Years Ended March 31,

2016

2015

2014

(In thousands)

Lease expense

$

49,780

$

79,798

$

100,466