U-Haul 2016 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (CONTINUED)

F-38

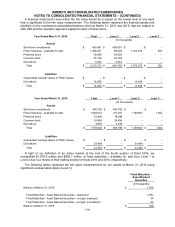

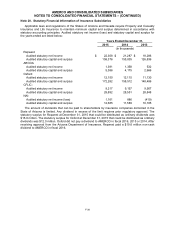

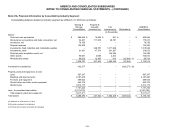

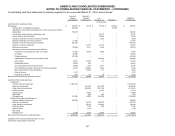

Note 20. Statutory Financial Information of Insurance Subsidiaries

Applicable laws and regulations of the States of Arizona and Nevada require Property and Casualty

Insurance and Life Insurance to maintain minimum capital and surplus determined in accordance with

statutory accounting principles. Audited statutory net income (loss) and statutory capital and surplus for

the years ended are listed below:

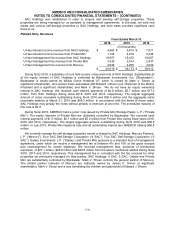

Years Ended December 31,

2015

2014

2013

(In thousands)

Repwest:

Audited statutory net income

$

22,308

$

21,287

$

18,286

Audited statutory capital and surplus

158,376

155,835

126,836

ARCOA:

Audited statutory net income

1,391

1,358

532

Audited statutory capital and surplus

5,386

4,175

2,666

Oxford:

Audited statutory net income

12,150

12,115

11,130

Audited statutory capital and surplus

172,282

158,512

148,486

CFLIC:

Audited statutory net income

9,217

9,157

9,567

Audited statutory capital and surplus

28,892

28,551

28,848

NAI:

Audited statutory net income (loss)

1,161

886

(419)

Audited statutory capital and surplus

12,685

11,589

10,185

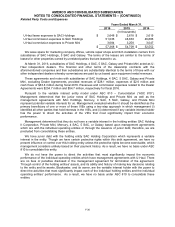

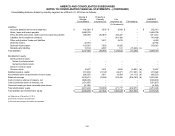

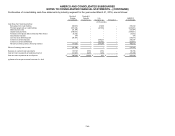

The amount of dividends that can be paid to shareholders by insurance companies domiciled in the

State of Arizona is limited. Any dividend in excess of the limit requires prior regulatory approval. The

statutory surplus for Repwest at December 31, 2015 that could be distributed as ordinary dividends was

$15.8 million. The statutory surplus for Oxford at December 31, 2015 that could be distributed as ordinary

dividends was $12.0 million. Oxford did not pay a dividend to AMERCO in fiscal 2016, 2015 or 2014. After

receiving approval from the Arizona Department of Insurance, Repwest paid a $19.6 million non-cash

dividend to AMERCO in fiscal 2016.